Snapdocs Inc. has debuted its eMortgage Quickstart Program – a tool for empowering lenders to more readily adopt eMortgages, or mortgages with electronic promissory notes (eNotes), by providing them with turnkey technology combined with expert eMortgage implementation and change management support.

As part of its continued efforts to promote eMortgage adoption, Freddie Mac will be working with Snapdocs to help lenders with their digital implementation and delivery efforts.

Digital closings have been a focal point for the industry for well over a decade. The use of eMortgages is known to reduce errors and costs associated with loan closings while also increasing lenders’ operational efficiency. Lenders have struggled with eMortgage adoption due to the unique technical components required to store and manage eNotes, the variability in counterparties’ digital closing acceptance policies, and the complexity of implementing and managing the process changes eMortgages require. The program was specifically designed to solve these challenges by providing lenders with the tools and support needed to effectively implement the use of eMortgages.

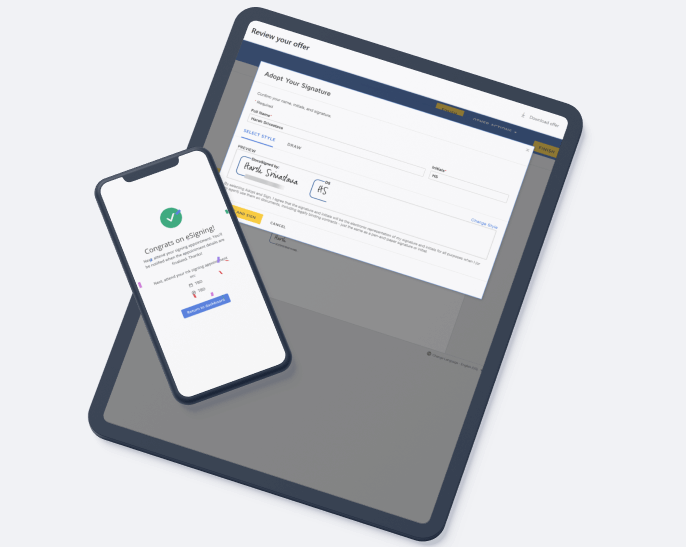

Snapdocs eMortgage Quickstart Program provides the technology necessary to generate, store, manage and transfer eMortgages that is agnostic to lenders’ existing point-of-sale systems (POS), loan origination systems (LOS) or doc prep providers. The program includes an eMortgage implementation framework combined with expert professional services to enable lenders to not only implement but operationalize and scale their use of eMortgages. The streamlined implementation processes between counterparties reduces complexity and facilitates eMortgage approval and onboarding processes.

An e-Eligibility engine helps lenders determine precisely how digital each closing can be while the forum enables participants to discuss the latest eMortgage developments and share best practices with others.

“Freddie Mac is a leader in eMortgage,” says Snapdocs’ head of industry and regulatory affairs, Camelia Martin. “They’ve paved the way for industry adoption through forward-thinking digital closing acceptance policies and support for lenders. We look forward to building upon Freddie Mac’s investments in eMortgage adoption by expanding access to the technology and resources lenders need to successfully digitize their closings.”

“In today’s competitive landscape, our lender clients are focused on innovative and efficient technologies that can extend value and reduce time and costs while improving customer experience,” mentions Sam Oliver, vice president of product delivery for Freddie Mac Single-Family. “We are excited about our partnership with Snapdocs and we look forward to working with them and our clients to continue the industry’s journey towards a true digital mortgage.”