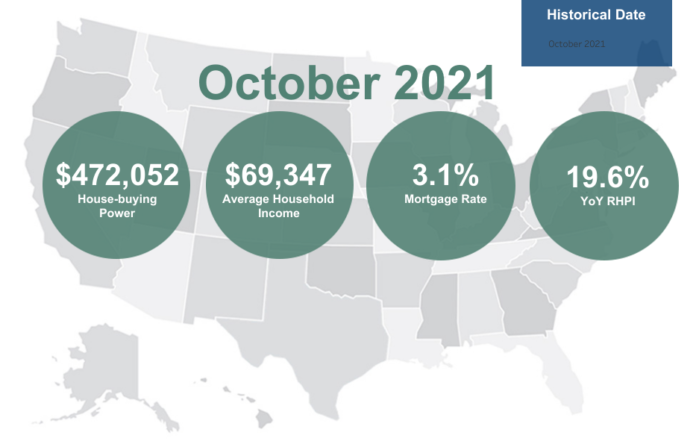

First American Financial Corp. has released the October 2021 First American Real House Price Index (RHPI) results, which measures the price changes of single-family properties throughout the U.S., adjusted for the impact of income and interest rate changes on consumer house-buying power over time at national, state and metropolitan area levels. Because the RHPI adjusts for house-buying power, it also serves as a measure of housing affordability.

“Affordability sank to its lowest level since 2008 in October, as two of the three key drivers of the RHPI swung in favor of reduced affordability relative to one year ago,” observes Mark Fleming, chief economist at First American. “Higher mortgage rates and record year-over-year nominal house price growth triggered a nearly 20 percent jump in the RHPI – rising RHPI values indicate declining affordability.

“The soaring nominal house prices and uptick in mortgage rates swamped any affordability gains from the 3.6 percent yearly increase in household income,” continues Fleming. “Since we know real estate is local, house-buying power and nominal house price gains vary by city, begging the question, where is affordability declining the most?”

The five markets with the greatest year-over-year decline in affordability were Phoenix (+33.7%); Charlotte, N.C. (+32.3%); Tampa, Fla. (+30.9%); Jacksonville, Fla. (+29.3%); and Memphis, Tenn. (+27.5%).

“In October, mortgage rates increased 0.2 percentage points relative to one year ago, which reduces affordability, all else held equal. Higher mortgage rates decrease affordability equally in each market as mortgage rates are generally similar across the country,” adds Fleming. “However, household income growth and nominal house prices vary by market, creating the market-level variance in affordability. Faster nominal house price appreciation can erode, or even eliminate, the boost in affordability from higher household income.

Consumer house-buying power, how much one can buy based on changes in income and interest rates, decreased 1.7% between September 2021 and October 2021, and increased 0.6% year over year. Median household income has increased 3.6% since October 2020 and 66.9% since January 2000.

“Phoenix suffered the greatest year-over-year loss in affordability in October, mostly due to the nearly 34 percent annual increase in nominal house price growth. Robust investor activity and strong net-in migration to Phoenix has fueled soaring demand for homes against a limited supply of homes for sale,” mentions Fleming. “In Charlotte, household income declined modestly, meaning all three key drivers of the RHPI dragged affordability down in October relative to one year ago.”

The five states with the greatest year-over-year increase in the RHPI are Arizona (+32.7%), Florida (+25.9%), South Carolina (+25.9%), Georgia (+24.8%) and Nevada (+23.7%). There were no states with a year-over-year decrease in the RHPI.

Among the Core Based Statistical Areas (CBSAs) tracked by First American, the five markets with the greatest year-over-year increase in the RHPI are Phoenix (+33.7%), Charlotte (+32.3%), Tampa (+30.9%), Jacksonville (+29.3%) and Memphis (+27.5%). Among the CBSAs tracked by First American, there were no markets with a year-over-year decrease in the RHPI.

“The importance of household income becomes apparent when comparing the decline in affordability in Charlotte to Tampa,” states Fleming. “While annual nominal house price appreciation in Tampa outpaced that of Charlotte, rising household income tempered the decline in affordability. Ultimately, nominal house price appreciation overwhelmed any affordability lift from house-buying power in all three of these markets.”

Real house prices increased 3.7% between September 2021 and October 2021, and grew 19.6% between October 2020 and October 2021. They are 7% less expensive than in January 2000. While unadjusted house prices are now 39.7% above the housing boom peak in 2006, real, house-buying power-adjusted house prices remain 34.7% below their 2006 housing boom peak.

“If affordability falls too far, some home buyers on the margin will pull back, prompting fewer bidding wars and causing house prices to moderate. In the near term, a labor market characterized by high demand, but limited supply means upward pressure on wages as employers compete to attract employees. While mortgage rates are expected to increase in 2022 as the economic recovery continues, consensus expectations still put them below 4 percent,” says Fleming. “For some home buyers, as the ‘big short’ in housing supply continues, it will become impossible to keep up with double-digit nominal house price growth, especially in a rising-rate environment. The challenge for home buyers in 2022 will mirror 2020 and 2021 – you can’t buy what’s not for sale even if you can afford to.”