Consumer desire for homeownership against persistently low supply of for-sale homes created one of the hottest housing markets in decades in 2021 – and spurred record-breaking home price growth, shows CoreLogic’s CoreLogic Home Price Index (HPI) for December 2021.

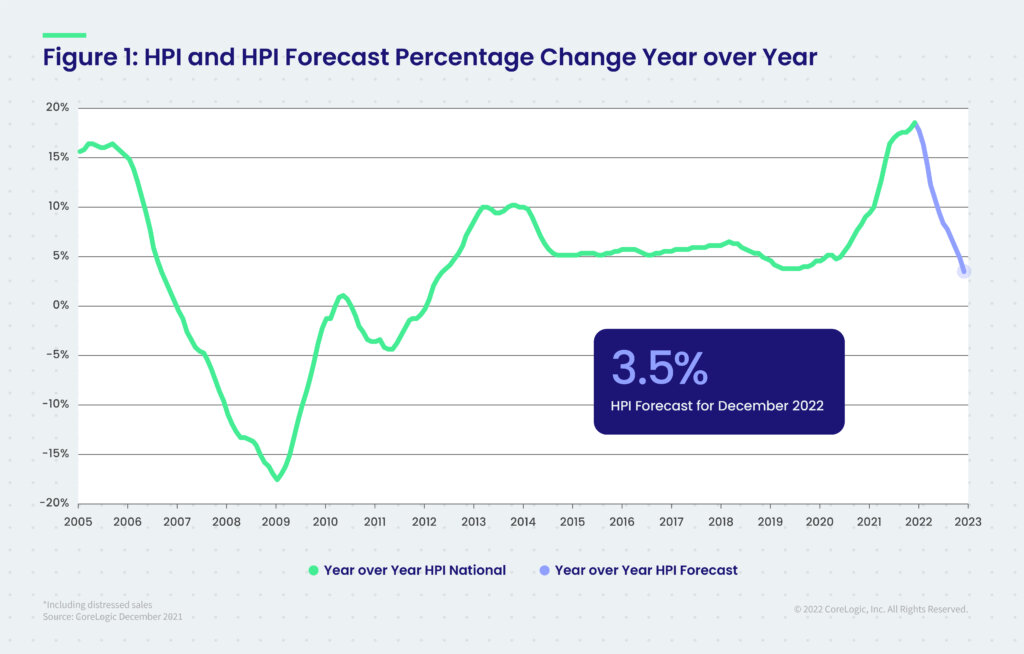

Price appreciation averaged 15% for the full year of 2021, up from the 2020 full year average of 6%. Home price growth in 2021 started off at 10% in the first quarter, steadily increasing and ending the year with an increase of 18% for the fourth quarter.

While there have been questions surrounding whether the U.S. is currently in a housing bubble, the CoreLogic Market Risk Indicators suggest a small probability of a nationwide price decline, and points to the larger likelihood that a fall in price will be limited to specific, at-risk markets. Still, the CoreLogic HPI Forecast shows the national 12-month growth steadily slowing over 2022. During the early months of the year, it’s projected to remain above 10% while decelerating each month to a 12-month rise of 3.5% by December 2022. Comparing the average projected National HPI for 2022 with the previous year, the CoreLogic HPI Forecast shows the annual average up 9.6% in 2022.

“Much of what we’ve seen in the run-up of home prices over the last year has been the result of a perfect storm of supply and demand pressures,” says Dr. Frank Nothaft, chief economist at CoreLogic. “As we move further into 2022, economic factors – such as new home building and a rise in mortgage rates – are in motion to help relieve some of this pressure and steadily temper the rapid home price acceleration seen in 2021.”

Nationally, home prices increased 18.5% in December 2021, compared to December 2020. On a month-over-month basis, home prices increased by 1.3% compared to November 2021. In December, annual appreciation of detached properties (19.7%) was 5.5 percentage points higher than that of attached properties (14.2%). Home price gains are projected to slow to a 3.5% annual increase by December 2022.

In December, Naples, Fla., logged the highest year-over-year home price increase at 37.6%. Punta Gorda, Fla., had the second-highest ranking at 35.7%.

At the state level, the Southern, Southwest and Mountain West regions continued to dominate the top three spots for national home price growth, with Arizona leading the way at 28.4%. Florida ranked second with a 27.1% growth and Utah followed in third place at 25.2%.