Aspire Home Loans LLC, an independent mortgage banker, has signed a contract to implement Black Knight Inc.’s Empower LOS and integrated origination performance solutions, including the Surefire customer relationship management (CRM) and marketing automation systems.

These capabilities will support first mortgages for Aspire Home Loans’ retail lending channel and help enhance the borrower experience, support its employees and help drive business growth.

“We were impressed with the lights-out process automation offered by Black Knight’s Empower system that will provide significant support to our lending team and improve our borrower experience,” says Brian Hill, Aspire Home Loans’ president and CEO. “When learning that the Optimal Blue pricing engine was being added to Black Knight’s suite of origination solutions, it made sense for us to take advantage of an integrated suite of capabilities that will help us originate more loans, reduce costs, increase operational efficiency and accelerate turn times.”

The Empower system’s “lights-out processing” automates many of the tasks associated with originating a loan with minimal human intervention. The Empower system actively monitors for key data changes – or lack of changes – throughout the loan process and triggers automated or manual tasks to be completed based on lender-configurable logic. This advanced automation helps to further mitigate lender risk and increase data integrity.

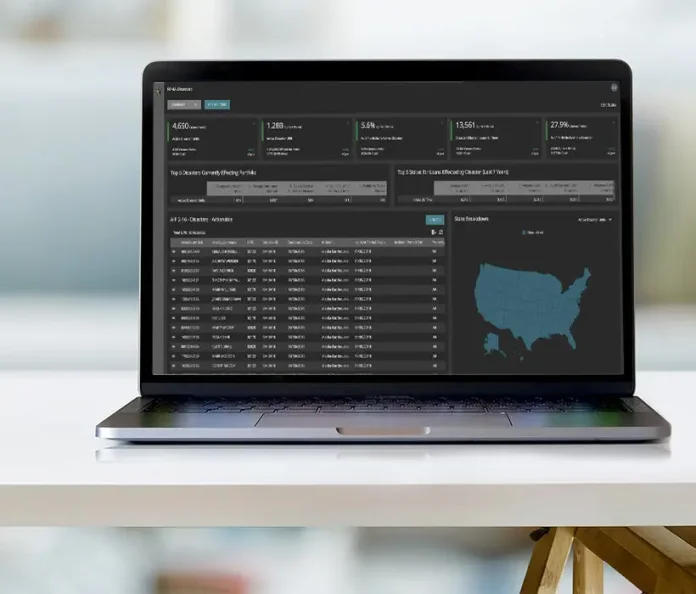

Aspire Home Loans will leverage Black Knight’s digital ecosystem by implementing Black Knight’s suite of integrated origination technology, data and analytics solutions. These include artificial intelligence and machine-learning for document classification and indexing; a point-of-sale solution that enhances the mortgage application process for borrowers and loan officers; a comprehensive fee service to help mitigate fee cures; and property tax data. It also includes connectivity with an online network of lenders and service providers; a digital close solution with eDelivery and eSigning capabilities; automated state and federal compliance validation testing; flood zone determination services and reporting; web APIs for automated real-time data transactions; and an actionable intelligence solution that delivers instant access to information from multiple data sources to help forecast and monitor pipeline, productivity, cycle time and pull-through.

The bank will also implement the Surefire mortgage-specific CRM and marketing automation capabilities to further enhance their customer engagements.

Aspire Home Loans will continue using Black Knight’s Optimal Blue product, pricing and eligibility engine (PPE), which helps the lender quickly provide borrowers the right product at the best price for a variety of mortgage financing scenarios. The Optimal Blue PPE delivers comprehensive functionality, enhances workflow efficiencies and enables mortgage lenders to execute profitable lending strategies.

“Empower is the right size and configurability for lenders of all sizes, including independent mortgage bankers like Aspire Home Loans,” comments Rich Gagliano, president of Black Knight Origination Technologies. “By using the Empower system and its full suite of integrated solutions, Aspire Home Loans will be in a great position to grow rapidly, let its loan officers focus more on customers and higher-level tasks, and offer borrowers the competitive rates and digital capabilities they have come to expect.”