Frost has signed an agreement to use Black Knight Inc.‘s integrated, end-to-end mortgage origination and servicing solutions, including the Empower loan origination system (LOS) and the MSP loan servicing system.

“By working with best-in-class providers like Black Knight, we can ensure that applying for mortgages will be an easy process,” says Bobby Berman, group executive vice president of research and strategy at Frost. “Frost will offer mortgages as part of our comprehensive suite of consumer loan products, and it’s important that we do so in keeping with the Frost philosophy and core values of integrity, caring and excellence.”

The advanced Empower LOS supports the origination of first mortgages and home equity loans, as well as retail, wholesale, consumer direct, home equity, assumptions and correspondent lending channels on a single platform. Using the Empower system, Frost will be able to manage its origination operations with greater speed and efficiency, which will help the bank lower operational costs and deliver a seamless borrower experience.

As loans transition into servicing, Frost will use the comprehensive Black Knight MSP loan servicing system, which is integrated with the Empower LOS, to further facilitate smooth, customer-focused processes across the loan life cycle. In addition, Black Knight’s Loss Mitigation application supports retention and liquidation workouts, which will help Frost streamline the loss mitigation process and reduce risk.

To complement the MSP system, Frost will have the ability to offer Servicing Digital, a customer-facing solution that delivers detailed, timely and highly personalized loan information about the value of consumers’ homes and how much wealth can be built from these real estate assets. Frost will use the native web version of Servicing Digital, which is also available as a mobile app.

Frost’s support representatives also will be able to leverage the Black Knight Customer Service solution to access the detailed, holistic and timely information necessary to deliver exemplary service at the point of customer contact. The solution presents a customer’s loan, home and neighborhood information through an intuitive, easy-to-use graphical interface. Customer Service is seamlessly integrated with both MSP and Black Knight’s Servicing Digital solution.

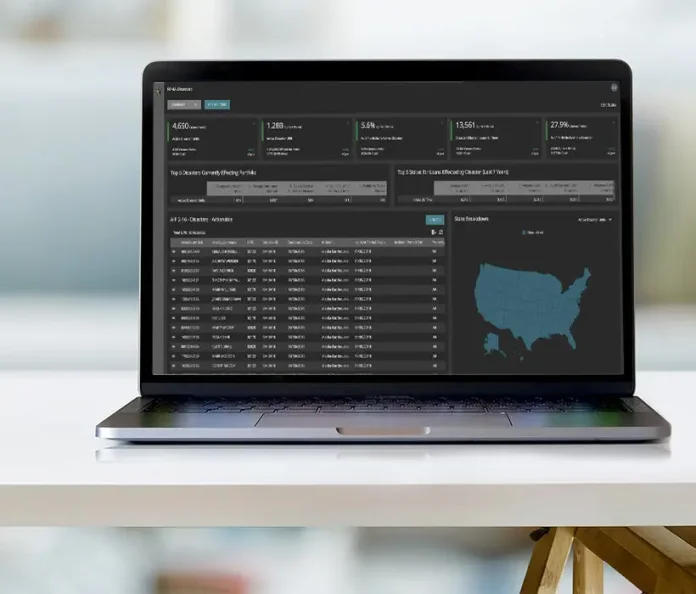

Finally, to further enhance both its origination and servicing operations, Frost will have the ability to implement Black Knight’s Actionable Intelligence Platform, which provides strategic and proactive analytics to the right individuals at the right time to help both lending and servicing clients gain and retain customers, reduce risk and decrease operational costs.

“Frost is an industry leader in customer service, and we’re excited to help it benefit from Black Knight’s proficiency in mortgage technology, data and analytics, and top-tier client support — from origination to servicing and beyond,” comments Joe Nackashi, president of Black Knight. “It’s a privilege to welcome Frost as a Black Knight enterprise client. We will share our expertise and best-in-class solutions to help launch and support their mortgage operations, while keeping efficiency, compliance and customer experience at the forefront.”