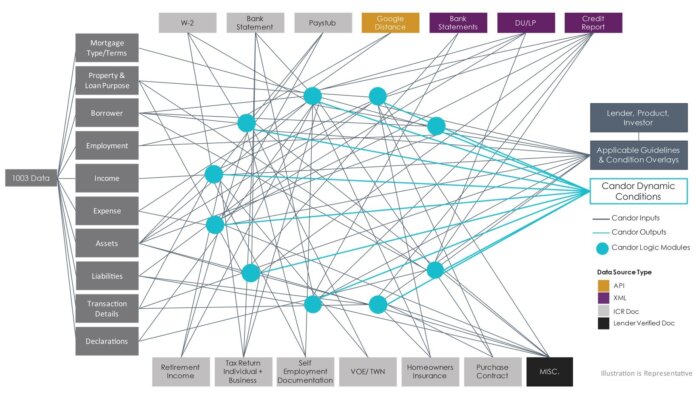

Candor Technology has added The Candor Metascore to its Loan Engineering System. The patent-pending Metascore indicates the overall quality of a loan. To produce the score, all loan data is first run through a dynamic 45,733 pivot point architecture to accurately assess investor guideline eligibility, then through a corroboration engine that conducts >1,100 crosschecks to identify and mitigate defects.

For transparency, all underlying metadata used during the autonomous process are saved to a Blockchain-type database. A Metascore of 85 or higher triggers eligibility for a defect insurance policy from a major international insurer.

Candor built its corroboration engine using aerospace principles so that the platform can simultaneously assess guideline eligibility and conduct crosscheck across multiple points of corroboration to identify and mitigate defects, ensuring integrity of the loan and the underlying metadata. Candor’s crosschecks are conducted in seconds.

“We developed the Metascore to benefit lenders manufacturing loans in the primary market and to benefit loan buyers in the secondary market,” says Candor CEO Tom Showalter. “If a loan has a high Metascore, a secondary market analyst can be confident a rigorous credit analysis was conducted, that guideline eligibility has been met, that the loan data faithfully reflect the status of the loan, and that loan can be efficiently priced.”

Candor Technology’s Loan Engineering System utilizes mortgage decision sciences technology to analyze credit and information risk analysis, identification, and mitigation machine.