Revisions to the Community Reinvestment Act (CRA) were signed into effect Tuesday by the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Office Of The Comptroller Of The Currency.

As per the revisions, which take effect in 2026, lenders will be required to market their loans to low-income Americans in wider geographical areas – factoring in mobile and online marketing.

In the past, the CRA grading system ranked lenders based on how well they served the areas only where they had retail locations. The new rule, however, takes into account the reach of the internet and requires lenders to report their CRA activities in areas outside of their brick and mortar footprint, based on volume. Whether this will make it harder for lenders to receive top marks when being graded for CRA compliance remains to be seen.

The changes take into account feedback solicited from industry groups – some of which have raised concerns related to increased regulatory complexity. But overall, industry support has been positive. In a statement, Rob Nichols, president and CEO of the American Bankers Association (ABA), says his group has “long supported the goals of the Community Reinvestment Act to make sure people in every corner of the country have the chance to succeed.”

“In demonstration of that commitment, banks of all sizes invested $287 billion in capital in low- and moderate-income areas in 2021 alone,” Nichols says. “We have also strongly supported modernizing the Community Reinvestment Act rules to reflect the realities of modern-day banking. The test for a CRA modernization rule is whether it incentivizes investment in underserved communities with requirements that are transparent, promote consistency and align with Congressional intent.

“We are still reviewing the nearly 1,500-page final rule released today, including changes from the proposed rule, to assess whether it meets our criteria,” Nichols says. “We are also closely examining whether the final rule can be reconciled with other major regulatory changes in play including the Basel III capital proposal. Feedback from our members will guide us moving forward.”

The revisions to the CRA had been in the works for years but were delayed amid fierce lobbying by industry groups – as well as a change in presidential administrations.

As per a “Fact Sheet” issued from the regulators, “the final rule will update the CRA regulations to evaluate lending outside traditional assessment areas generated by the growth of non-branch delivery systems, such as online and mobile banking, branchless banking, and hybrid models. It is calibrated to recognize the continued importance of bank branches, while establishing a framework to evaluate the digital delivery of banking products and services for certain banks.”

The final rule also “adopts a new metrics-based approach to evaluating bank retail lending and community development financing, using benchmarks based on peer and demographic data. The agencies will develop data tools using reported loan data that give banks and the public additional insight into performance standards. The final rule also clarifies eligible CRA activities, such as affordable housing, that are focused on LMI, underserved, native, and rural communities.”

A separate, earlier statement from the OCC states that the new rule will require regulators “to develop, publish, and maintain a publicly available list of pre-approved CRA activities.”

“The list would be illustrative, not exhaustive, and would be updated regularly,” the OCC says in its 2020 statement, adding that the new rules “establish a process for stakeholders to submit additional items for inclusion on the list.”

In addition the revised rule “recognizes differences in bank size and business models. For example, small banks will continue to be evaluated under the existing framework with the option to be evaluated under the new framework. The rule also exempts small and intermediate banks from new data requirements that apply to banks with assets of at least $2 billion and limits certain new data requirements to large banks with assets greater than $10 billion.”

In a statement, Rohit Chopra, director of the Consumer Financial Protection Bureau, and a member the FDIC board of directors, says “Banks are not ordinary businesses. They are critical infrastructure of the economy. This is why we provide them with many public benefits, and in exchange, they have obligations to meet the ‘convenience and needs’ of the communities they serve.”

“The final rule is the product of compromise between the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, and the Federal Reserve Board of Governors, and it is a step forward from the rules developed decades ago,” Chopra says. “The final rule should help increase investment and lending in historically excluded communities, including rural communities.”

The revised framework applies to banks based on asset size and business model, with banks classified as large, intermediate, small, or limited purpose, with a different compliance framework for each.

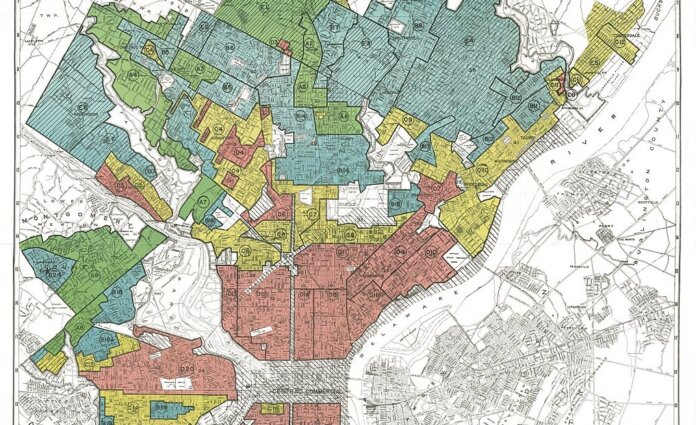

Photo: Public Domain