DocMagic Inc., a provider of fully compliant loan document preparation, automated regulatory compliance and comprehensive eMortgage services, has rolled out eDecision, a solution that expands the level of analysis applied to e-eligibility determination for eClosings. The result is a decision that tells users precisely how far they can take a digital closing based on the unique attributes of the loan transaction – all the way down to county-level eRecording acceptance.

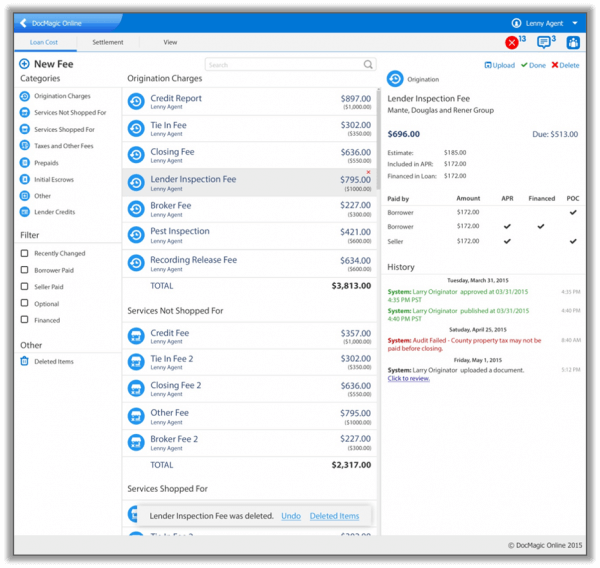

eDecision is powered by DocMagic’s audit engine, which begins the decisioning process as soon as the first set of disclosures is generated – starting as early as the point-of-sale – and continuing with e-eligibility checks throughout the entire loan process. The solution accesses and compiles first-party data.

“Our goal in developing eDecision was straightforward: to help clients execute flawless eClosings and bring a new level of automation to the overall process by providing lenders with an immediate determination of how ‘e’ they can be,” says Dominic Iannitti, president and CEO of DocMagic. “Simply put, eDecision equates to eSuccess for all parties involved in the closing process.”

The eDecision solution does not force users to leave DocMagic’s platform and visit another website, use a third-party application or access an ancillary database. Everything eDecision offers is available within DocMagic’s core process and is provided as an integral component of the eClosing workflow.

DocMagic’s Total eClose solution offers four types of compliant eClosings. eDecision automatically confirms whether a lender is certified to originate eNotes, is registered with MERS and has completed their MERS end-to-end testing. It automatically validates whether the local recording jurisdiction is able to accept an electronically executed security instrument. It also confirms whether KBA is required in the closing state where it occurs. eDecision identifies which type of notarization is accepted within the jurisdiction: remote online notarization (RON), in-person electronic notarization (IPEN) or traditional in-person notarization. It will also soon provide a determination of whether an investor will purchase an electronically closed loan, saving time for secondary marketing departments.

All analysis and results from eDecision are incorporated into DocMagic’s Loan Detail Report (LDR), which is automatically included with all document requests and is widely accepted by most investors as proof of regulatory compliance. Furthermore, DocMagic’s audit engine automates data and document validation throughout all phases of the lending process to ensure accuracy while performing continuous compliance checks to ensure strict adherence to applicable rules and regulations.

“At DocMagic, with each innovation we engineer, we strive to eliminate manual processes and improve the overall user experience,” adds Iannitti. “We don’t want our clients having to go elsewhere to research or rely on disparate third-party systems for what we believe should be a fully integrated analysis that begins the moment our services are accessed for a particular loan transaction. eDecision gives lenders, settlement providers and notaries a completely integrated digital closing determination process – and the confidence they need to begin offering eClosings on a widespread scale.”