Existing-home sales increased in October, marking two straight months of growth, according to the National Association of Realtors (NAR).

Two of the four major U.S. regions saw month-over-month sales climb, one region reported a drop, and the fourth area held steady in October. On a year-over-year basis, each region witnessed a sales decrease.

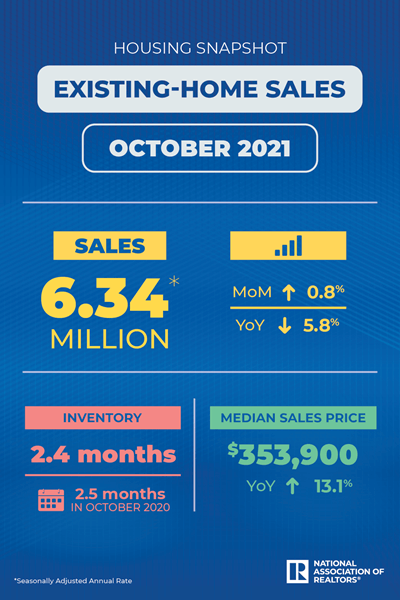

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – rose 0.8% from September to a seasonally adjusted annual rate of 6.34 million in October. Sales fell 5.8% from a year ago (6.73 million in October 2020).

“Home sales remain resilient, despite low inventory and increasing affordability challenges,” observes Lawrence Yun, NAR’s chief economist. “Inflationary pressures, such as fast-rising rents and increasing consumer prices, may have some prospective buyers seeking the protection of a fixed, consistent mortgage payment.”

Total housing inventory at the end of October amounted to 1.25 million units, down 0.8% from September and down 12.0% from one year ago (1.42 million). Unsold inventory sits at a 2.4-month supply at the current sales pace, equal to September’s supply, and down from 2.5 months in October 2020.

The median existing-home price for all housing types in October was $353,900, up 13.1% from October 2020 ($313,000), as prices climbed in each region. This marks 116 straight months of year-over-year increases, the longest-running streak on record.

“Among some of the workforce, there is an ongoing trend of flexibility to work anywhere, and this has contributed to an increase in sales in some parts of the country,” adds Yun. “Record-high stock markets and all-time high home prices have worked to significantly raise total consumer wealth and, when coupled with extended remote work flexibility, elevated housing demand in vacation regions.”

Properties typically remained on the market for 18 days in October, up from 17 days in September and down from 21 days in October 2020. Eighty-two percent of homes sold in October 2021 were on the market for less than a month.

In October, first-time buyers were responsible for 29% of sales, up from 28% in September and down from 32% in October 2020. NAR’s 2021 Profile of Home Buyers and Sellers – released earlier this month – reported that the annual share of first-time buyers was 34%.

Individual investors or second-home buyers, who make up many cash sales, purchased 17% of homes in October, up from both 13% in September and from 14% in October 2020. All-cash sales accounted for 24% of transactions in October, up from both 23% in September and from 19% in October 2020.

Distressed sales – foreclosures and short sales – represented less than 1% of sales in October, equal to the percentage seen a month prior and equal to October 2020.

According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage was 3.07 in October, up from 2.90% in September. The average commitment rate across all of 2020 was 3.11%.

Single-family home sales rose to a seasonally adjusted annual rate of 5.66 million in October, up 1.3% from 5.59 million in September and down 5.8% from one year ago. The median existing single-family home price was $360,800 in October, up 13.5% from October 2020.

Existing condominium and co-op sales were recorded at a seasonally adjusted annual rate of 680,000 units in October, down 2.9% from 700,000 in September and down 5.6% from one year ago. The median existing condo price was $296,700 in October, an annual increase of 8.7%.

“At a time when mortgage rates are still low, buying and securing a home is a wise investment,” says NAR President Leslie Rouda Smith, a realtor from Plano, Texas, and a broker associate at Dave Perry-Miller Real Estate in Dallas. “NAR will strive to make homeownership obtainable for all who want to pursue one of the key components of the American Dream.”

Existing-home sales in the Northeast fell 2.6% in October, registering an annual rate of 750,000, a 13.8% decline from October 2020. The median price in the Northeast was $379,100, up 6.4% from one year ago.

Existing-home sales in the Midwest rose 4.2% to an annual rate of 1,500,000 in October, a 6.3% decrease from a year ago. The median price in the Midwest was $259,800, a 7.8% jump from October 2020.

Existing-home sales in the South increased 0.4% in October, posting an annual rate of 2,780,000, a 3.5% drop from one year ago. The median price in the South was $315,500, a 16.1% climb from one year prior.

Existing-home sales in the West neither rose nor fell from the prior month’s level, registering an annual rate of 1,310,000 in October, down 5.1% from one year ago. The median price in the West was $507,200, up 7.7% from October 2020.