Inflation is a key forecast concern for the economy, according to the November 2021 commentary from the Fannie Mae’s Economic and Strategic Research (ESR) Group.

The ESR Group’s expectations for inflation were upgraded meaningfully in the near term to average 6.2% on an annual basis in the fourth quarter. The forecast anticipates the recent price gains to begin to moderate over the coming quarters as temporary factors begin to wane, but the build-up of stronger, underlying inflationary pressure suggests that inflation will remain significantly above the Federal Reserve’s 2% target through 2023.

The Fed is therefore expected to begin hiking its target rate in 25-basis-point increments beginning in Q4 2022. However, if inflation continues to exceed expectations, there is increasing risk that the Fed will begin raising interest rates even earlier. The principal risks to the forecast remain the pace of global supply recovery, the availability and cost of labor, and the extent of Federal monetary and fiscal largesse.

The ESR Group also published for the first time its expectations for 2023 real gross domestic product (GDP) growth, which it projects at 2.1%, very much in line with the pre-pandemic domestic growth trend. Over the next few quarters, the forecast expects the primary drivers of growth to be inventory restocking by businesses and increased spending on services by consumers. Expectations for full-year 2021 and 2022 economic growth remained largely consistent this month, with 2021’s projection revised downward by 0.1 percentage points to 4.8% and 2022’s projection revised slightly upward by the same amount to 3.7%.

“The Fed is in motion, pushed by inflation running ahead of their forecasts and looking less transitory than they had anticipated,” observes Doug Duncan, Fannie Mae’s senior vice president and chief economist. “They left themselves some room for policy change by committing to the speed of tapering assets for only two months, where adjustments could be made thereafter.”

“Economic growth continues to slow, but not precipitously; and as rates have not yet reacted strongly, housing and mortgage activity remain very strong. Market participants will have one eye on the monthly inflation releases and the other eye on the Fed in the months ahead. How credible investors, business leaders, and consumers find the Federal Reserve’s evolving beliefs regarding the passing or sustained level of inflation and resulting monetary policy actions will be key – their choices will impact economic growth as well as housing and mortgage activity.”

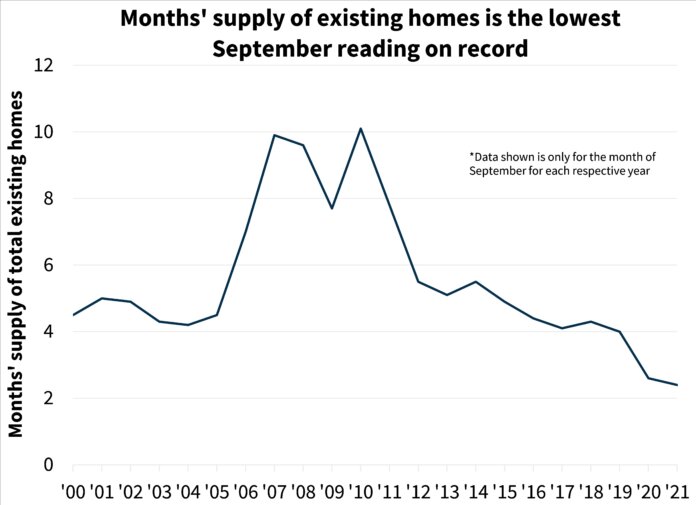

On housing, the ESR Group revised upward its expectations for 2021 home sales but downward its projection for 2021 home construction. While mortgage demand remains strong, homebuilding continues to be constrained by supply chain bottlenecks and a lack of specialty trade labor, although the ESR Group expects some of those constraints to ease in the coming months, enabling 4.8% growth in single-family home starts and 13.9% growth in new single-family home sales in 2022.

With regard to mortgage originations, the ESR Group expects purchase volumes to total $1.9 trillion in 2021 followed by 6.8% growth in 2022 to $2.0 trillion. Refinance volumes of $2.5 trillion are projected in 2021 before slowing in 2022 and 2023 to $1.3 trillion and $1.1 trillion, respectively. Finally, owing in part to the expectation that the Fed will begin to raise interest rates later next year, the ESR Group expects the 30-year fixed mortgage rate to average 3.3% in 2022 and 3.5% in 2023.

Read the full November 2021 Economic Outlook here.