The Federal Housing Administration (FHA) has set its loan limits for 2024.

Starting January 1, the FHA floor will increase from $472,030 to $498,257 for single-family home loans.

FHA’s ceiling loan limits – the maximum loan amount the agency will insure – will increase from $1,089,300 to $1,149,825 for a single-family property.

In Alaska, Hawaii, Guam and the U.S. Virgin Islands, the ceiling rises to $1,724,725.

The loan limits were expected to increase for most of the country, as home prices have increased significantly during the past year.

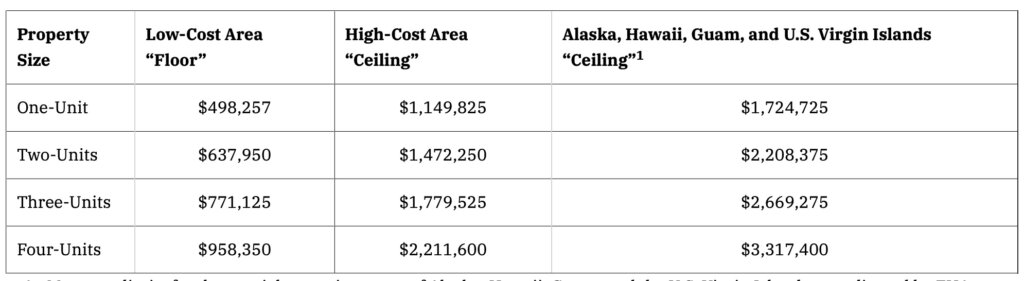

The following table lists the 2024 FHA loan limits for low- and high-cost areas:

The FHA also increased the loan limits for its Home Equity Conversion Mortgage (HECM), or reverse mortgage program, to $1,149,825.

The HECM program regulations do not allow loan limits to vary by MSA or county, so this limit applies to all mortgages regardless of location.

“The statutory loan limit increases announced today reflect the continued rise in home prices seen throughout most of the nation in 2023,” says Julia Gordon, assistant secretary for housing and federal housing commissioner, in a statement. “The increases to FHA’s loan limits will enable homebuyers to use FHA’s low-down-payment financing to access homeownership at a time when a lack of affordability threatens to shut well qualified borrowers out of the market.”

FHA is required to update its annual loan limits each year using a formula prescribed in the National Housing Act. This formula uses county or Metropolitan Statistical Area (MSA) home sale data to derive new loan limits for the three different cost categories established by the law.