First American Data & Analytics, a division of First American Financial Corp., has debuted Procision, a new automated valuation model (AVM) suite that uses a blended ensemble modeling approach to deliver accuracy to lenders and financial services clients, proptech companies, and other real estate data consumers.

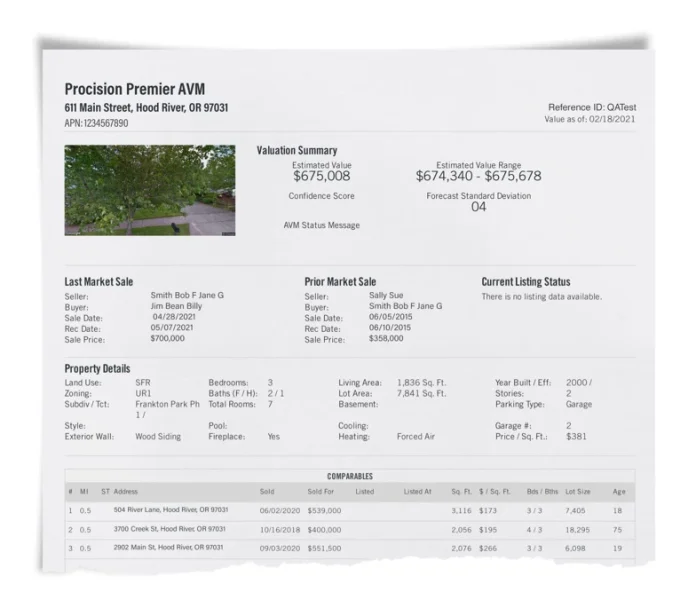

The Procision AVM suite includes three AVM solutions, each designed to suit the demands of different clients. Procision Premier is a lender-grade AVM while the Procision Power AVM can be embedded on client websites. The Procision Direct AVM offers portfolio analysis and can be used to create targeted marketing campaigns. The suite is built on the latest technology infrastructure, which is fully scalable and enables easy integration of new data.

“Our new Procision AVM suite leverages the most sophisticated modeling techniques, the latest machine-learning technologies and the industry’s largest property and ownership database to set a new standard for accuracy and reliability,” says Robert Karraa, president of First American Data & Analytics. “With its unique and robust blend of models and sub-models, the quality of the valuations produced by Procision is unmatched.”

For added accuracy and currency, First American Data & Analytics runs Procision AVM valuations on every residential property in the U.S. every day and the company also updates the underlying data that fuels the Procision AVM suite daily. An automated surveillance system constantly monitors both data and valuation quality, and performs extensive testing to validate the accuracy of the valuations produced for various property types in various geographic markets. The suite provides the documentation required by lending regulations.

“Lenders, servicers and capital market decision makers need highly accurate, highly reliable industrial-grade valuations to inform their risk decisions,” states Jon Wierks, vice president of analytics at First American Data & Analytics. “Marketers designing campaigns based on home price or home equity, on the other hand, are looking for broad coverage with high hit rates at an affordable price point. There are also a growing number of proptechs and emerging businesses in the mortgage and real estate industries that provide a preliminary home price estimate to their prospective customers, which is precisely what our white-label model is designed to do.”