FormFree’s AccountChek digital asset verification service is now supporting a new enhancement to Freddie Mac’s Loan Product Advisor (LPASM) asset and income modeler (AIM) solution that makes assessment of borrower employment easier, faster, less expensive and more fraud-resistant.

Under Freddie Mac Single-Family Seller/Servicer Guide requirements, with limited exceptions, mortgage lenders must verify each borrower’s employment during the initial loan application, then again within 10 days of the loan’s closing date. The verification, done prior to closing, is officially known as the 10-day Pre-Closing Verification or “10-day PCV.”

To fulfill the Freddie Mac 10-day PCV requirement, lenders have historically had to furnish a verbal, email or written verification of employment (VOE) or pay a third-party service provider for an electronic VOE report. Now, with the latest enhancement to AIM, lenders can automatically satisfy the 10-day PCV requirement using account or payroll data using FormFree’s AccountChek.

Automation of the 10-day PCV using account data is available to all Freddie Mac clients effective June 1. Freddie Mac describes the service as “an improved way to assess borrower employment” that offers superior speed, cost and fraud resistance compared to alternatives.

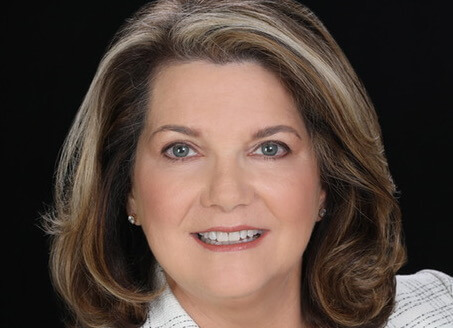

“Verifying a loan applicant’s employment in the runup to the loan closing protects lenders, investors and borrowers alike. But the process can be time-consuming and expensive, and it’s only gotten worse with so many Americans working remotely,” says Christy Moss, FormFree’s chief customer officer. “The Work Number is expensive. Manual employment verification is time-consuming. Using direct-source asset data to fulfill the 10-day PCV is an economical and efficient solution, and it couldn’t come at a better time for an industry that is losing sleep over razor-thin margins.”

AccountChek streamlines the mortgage process by empowering borrowers to share their asset and payroll data electronically in an underwriter-friendly format lenders can use to assess asset, income and employment in seconds. By leveraging a business-applicable refresh period, lenders that use AccountChek for a loan applicant’s initial employment verification will be able to generate the VOE report within 10 days of closing.