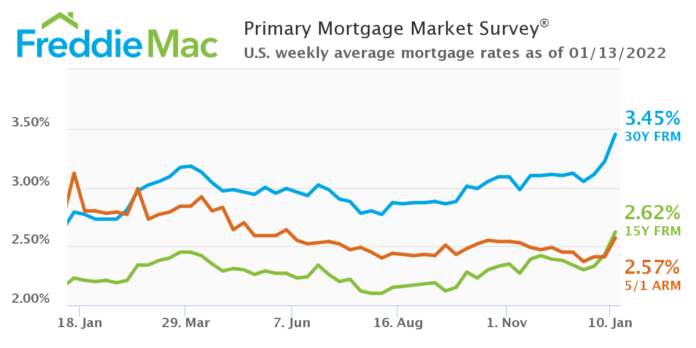

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing that the 30-year fixed-rate mortgage (FRM) averaged 3.45% for the week ending January 13.

“Mortgage rates rose across all mortgage loan types, with the 30-year fixed-rate mortgage increasing by almost a quarter of a percent from last week,” says Sam Khater, Freddie Mac’s chief economist. “This was driven by the prospect of a faster than expected tightening of monetary policy in response to continued inflation exacerbated by uncertainty in labor and supply chains. The rise in mortgage rates so far this year has not yet affected purchase demand, but given the fast pace of home price growth, it will likely dampen demand in the near future.”

The 30-year fixed-rate mortgage averaged 3.45% with an average 0.7 point, up from last week, when it averaged 3.22%. A year ago at this time, the 30-year FRM averaged 2.79%.

The 15-year fixed-rate mortgage averaged 2.62% with an average 0.7 point, up from last week, when it averaged 2.43%. A year ago at this time, the 15-year FRM averaged 2.23%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.57% with an average 0.3 point, up from last week, when it averaged 2.41%. A year ago at this time, the 5-year ARM averaged 3.12%.