Freddie Mac is offering a $2,500 credit to help with down payment and other closing costs for low-income families looking to purchase a home.

The credit is available to potential homebuyers earning 50% of area median income or less. The initiative will extend more broadly to very low-income families who qualify for the company’s Home Possible and HFA Advantage products.

“Today’s announcement is a vital lifeline for would-be homeowners, as studies show that down payment and closing costs are among the largest barriers to homeownership for very low-income homebuyers,” says Sonu Mittal, senior vice president and head of single-family acquisitions at Freddie Mac, in a release. “Our commitment to supporting these families runs deep, as we have provided assistance to this population through various programs since 2018. We are pleased to now make this assistance more broadly available to borrowers through our Home Possible program.”

The new credit will be available to qualifying homebuyers starting March 1. Funds can be used in several ways, including down payment, closing costs, escrow and mortgage insurance premiums.

The announcement comes after a strong 2023 for Freddie Mac, with the company financing approximately 800,000 home purchases.

First-time homebuyers represented approximately 51% of those purchases, the highest percentage since the company started tracking that statistic three decades ago.

In addition, the company expects it will achieve all of its 2023 affordable housing goals set by the Federal Housing Finance Agency.

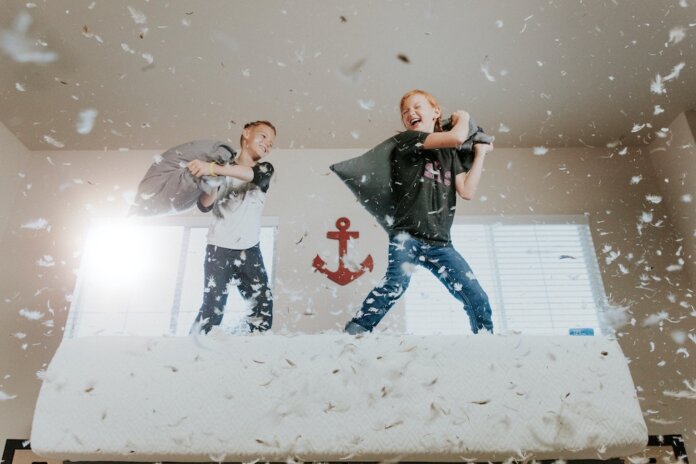

Photo: Allen Taylor