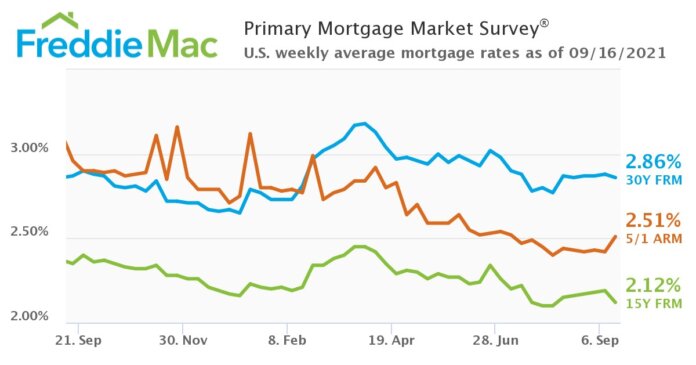

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing that the 30-year fixed-rate mortgage (FRM) averaged 2.86% for the week ending September 16.

“It’s Groundhog Day for mortgage rates, as they have remained virtually flat for over two months,” says Sam Khater, Freddie Mac’s chief economist. “The holding pattern in rates reflects the markets’ view that the prospects for the economy have dimmed somewhat due to the rebound in new COVID cases.

“While our collective attention is on the pandemic, fundamental changes in the economy are occurring, such as increased migration, the extended continuation of remote work, increased use of automation, and the focus on a more energy efficient and resilient economy,” continues Khater. “These factors will likely lead to significant investment and new post-pandemic economic models that will spur economic growth.”

The 30-year fixed-rate mortgage averaged 2.86% with an average 0.7 point, down slightly from last week when it averaged 2.88%. A year ago at this time, the 30-year FRM averaged 2.87%.

The 15-year fixed-rate mortgage averaged 2.12% with an average 0.6 point, down from last week when it averaged 2.19%. A year ago at this time, the 15-year FRM averaged 2.35%. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.51% with an average 0.1 point, up from last week when it averaged 2.42%. A year ago at this time, the five-year ARM averaged 2.96%.

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit. Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Borrowers may still pay closing costs which are not included in the survey.