Freddie Mac has released an analysis showing that appraisal values are more likely to fall below the contracted sale price of a home in census tracts with a higher share of Black and Latino households, resulting in an appraisal gap. The extent of that gap increases as the percentage of Black and Latino individuals in the census tract increases.

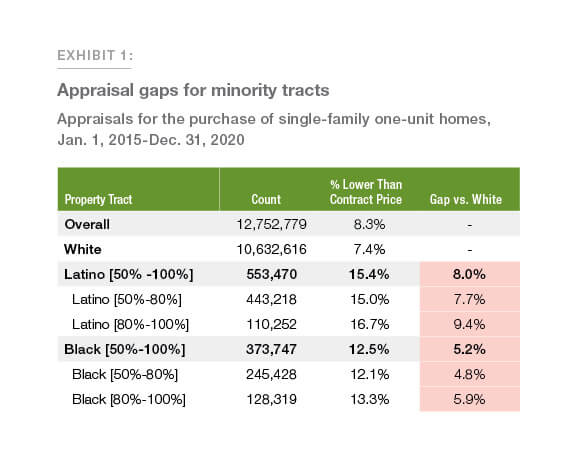

The research is based on 12 million appraisals for purchase transactions submitted to Freddie Mac between 2015 and 2020 through the Uniform Collateral Data Portal.

“An appraisal falling below the contracted sale price may allow a buyer to renegotiate with a seller, but it could also mean families might miss out on the full wealth-building benefits of homeownership or may be unable to get the financing needed to achieve the American Dream in the first place,” says Michael Bradley, senior vice president of modeling, econometrics, data science and analytics in Freddie Mac’s single-family division. “This is a persistent problem that disproportionately impacts hundreds of thousands of Black and Latino applicants.”

“Our research marks the beginning of a comprehensive effort to better understand the key drivers contributing to the appraisal gap,” continues Bradley. “Our goal is to develop solutions to this persistent problem, including appraisal best practices, uniform standards for automated valuation models, enhanced consumer disclosures, improved value processes, and revised fair lending exam procedures and risk assessments.”

The appraisal gaps identified are not being driven by only a small fraction of appraisers – a large portion of appraisers who completed appraisals in both minority and non-minority areas generated statistically significant gaps.

Properties in Black and Latino tracts receive appraisal values lower than the contract price more often than those in White tracts – 12.5% of the properties in Black tracts receive appraisal values lower than the contract price compared to 7.4% for those in White tracts, leading to a gap of 5.2%.

As the concentration of Black or Latino individuals in a census tract increases, the appraisal gap increases. For example, as the population of Latino individuals increase, the appraisal gap for properties in Latino tracts increases from 7.7% to 9.4%.

Differences in comparable sale distances, comparable reconciliation, variances in comparable sale prices and possible systematic overpayment for properties by minorities can explain only a modest amount of the observed appraisal gaps for the minority tracts.

Analysis was conducted on appraisals for the purchase of a single family one-unit home. Numerous robustness checks from different perspectives were conducted as part of the analysis, including by appraisal type, occupancy type, property condition, housing trend indicated in the appraisal report and by urbanization level. In addition, analysis was conducted on the top 30 Metropolitan Statistical Areas. The patterns observed based on the aggregate national data mostly persist; thus, the appraisal gaps seem pervasive.