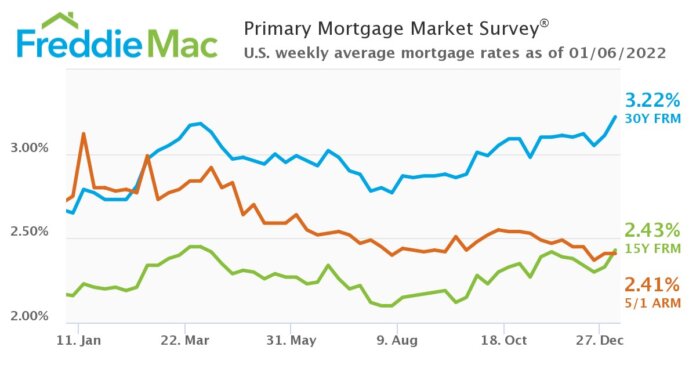

The results of Freddie Mac’s Primary Mortgage Market Survey (PMMS) show that the 30-year fixed-rate mortgage (FRM) averaged 3.22% for the week ending January 6.

“Mortgage rates increased during the first week of 2022 to the highest level since May 2020 and are more than half a percent higher than January 2021,” says Sam Khater, Freddie Mac’s chief economist. “With higher inflation, promising economic growth and a tight labor market, we expect rates will continue to rise. The impact of higher rates on purchase demand remains modest so far given the current first-time homebuyer growth.”

The 30-year fixed-rate mortgage averaged 3.22% with an average 0.7 point, up from last week when it averaged 3.11%. A year ago at this time, the 30-year FRM averaged 2.65%.

The 15-year fixed-rate mortgage averaged 2.43% with an average 0.6 point, up from last week when it averaged 2.33%. A year ago at this time, the 15-year FRM averaged 2.16%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.41% with an average 0.5 point, unchanged from last week. A year ago at this time, the 5-year ARM averaged 2.75%.