FormFree’s AccountChek digital asset verification service is supporting a Freddie Mac solution that allows mortgage lenders to assess a prospective home buyer’s income using direct deposit data.

Available to mortgage lenders nationwide, Freddie Mac’s Loan Product Advisor (LPASM) asset and income modeler (AIM) solution fulfills mortgage verification of assets (VOA) and verification of income (VOI) requirements.

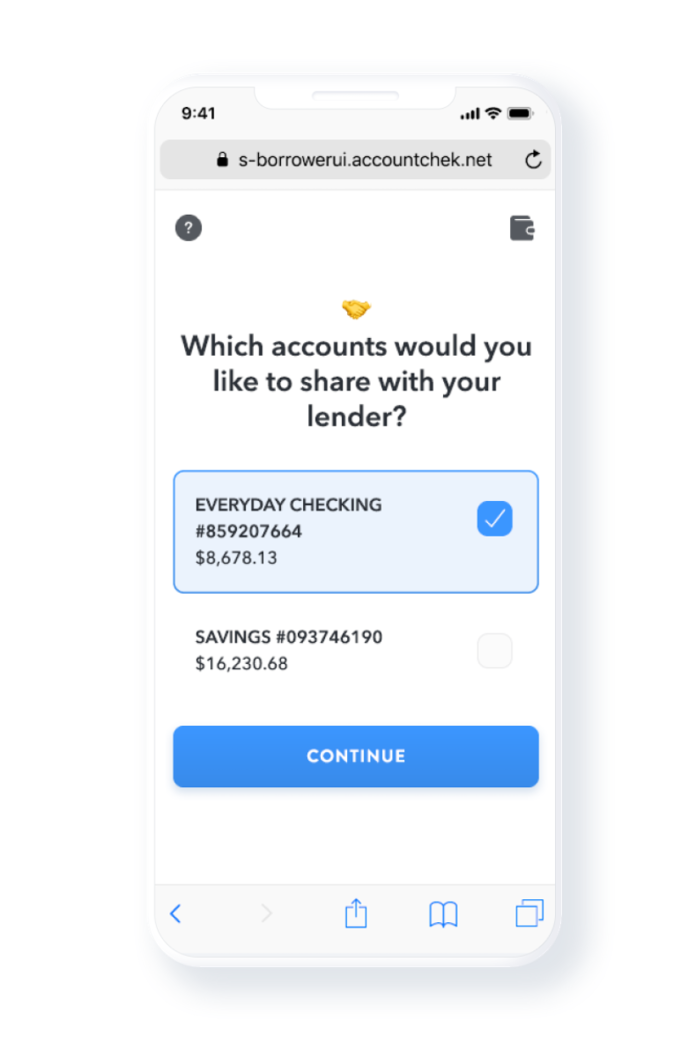

FormFree’s AccountChek leverages tens of thousands of data connections with more than 16,000 financial institutions to instantly deliver consumer-permissioned asset and income verification all in one report. With an estimated 93% or more of U.S. workers paid via direct deposit, collapsing asset and income verification into a single, paperless step provides cost-saving efficiencies for lenders, reduces the risk of fraud and manual errors, and helps borrowers get approved for their homes more quickly.

“We have long contended that a consumer’s data – in particular, asset data sourced directly from financial institutions and extending over 12 months or more – holds the key to better understanding consumers’ financial DNA, streamlining lenders’ underwriting processes and driving inclusion in homeownership,” says Brent Chandler, FormFree’s founder and CEO. “This latest enhancement to Freddie Mac’s AIM brings lenders money-saving process efficiencies by making income assessment instantaneous.”

“We’re pleased to have FormFree’s AccountChek product support this game-changing enhancement to our AIM offering,” states Christina Randolph, director of strategic technology partnerships at Freddie Mac. “Partnering with FormFree has helped unlock more consumer financial data that allows us to uphold our risk management standards while streamlining the mortgage process and increasing homeownership opportunities.”