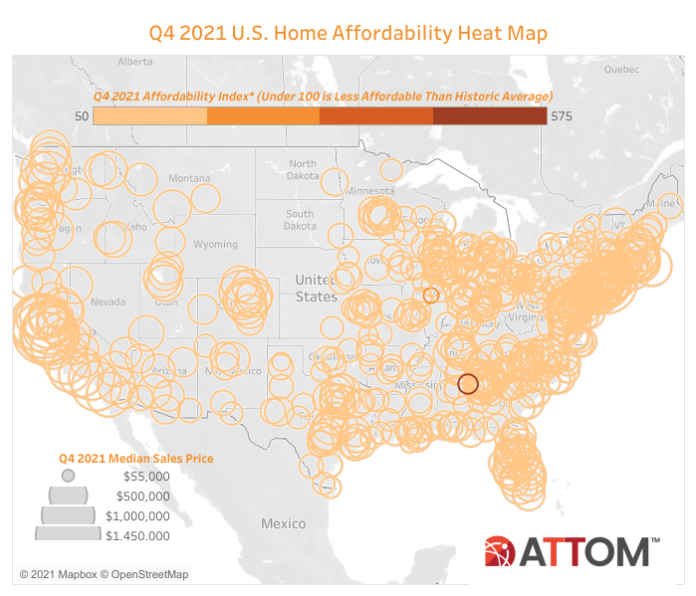

ATTOM’s fourth-quarter 2021 U.S. Home Affordability Report shows that median-priced single-family homes were less affordable in the fourth quarter compared to historical averages in 77% of counties across the nation with enough data to analyze.

That’s up from just 39% of counties that were historically less affordable in the fourth quarter of 2020, to the highest point in 13 years, as home prices continue rising faster than wages throughout much of the country.

The report determined affordability for average wage earners by calculating the amount of income needed to meet major monthly home ownership expenses – including mortgage, property taxes and insurance – on a median-priced single-family home, assuming a 20% down payment and a 28% maximum “front-end” debt-to-income ratio. That required income was then compared to annualized average weekly wage data from the Bureau of Labor Statistics.

Compared to historical levels, median home prices in 440 of the 575 counties analyzed in the fourth quarter of 2021 are less affordable than past averages. The latest number is up from 428 of the same group of counties in the third quarter of 2021 and 224 in the fourth quarter of 2020 – an increase that has continued as the median national home price has shot up 17% over the past year to a record high of $317,500.

While major ownership costs on median-priced homes do remain within the financial means of average workers across the nation in the fourth quarter of 2021, the percentage of counties where affordability is worse than historical averages has hit another high point since the third quarter of 2008.

The latest pattern – home prices still manageable but getting less affordable – has resulted in major ownership costs on the typical home consuming 25.2% of the average national wage of $65,546 in the fourth quarter of this year. That is up from 24.4% in the third quarter of 2021 and 21.5% in the fourth quarter of last year. Still, the latest level is within the 28% standard lenders prefer for how much homeowners should spend on mortgage payments, home insurance and property taxes.

The mixed fourth-quarter patterns follow similar trends over the past year as the U.S. housing market continues booming for the 10th straight year both because of an in spite of the coronavirus pandemic that hit in early 2020 and damaged major sectors of the U.S. economy.

House hunters largely unscathed financially by the pandemic have surged into the market amid a combination of mortgage rates hovering around 3% and a desire to trade congested virus-prone areas for the perceived safety of a house and yard, as well as the space for growing work-at-home lifestyles. But they have been chasing a tight supply of homes made tighter by the pandemic. The soaring demand combined with the limited supply have pushed prices ever higher and affordability downward.

“The average wage earner can still afford the typical home across the United States, but the financial comfort zone continues shrinking as home prices keep soaring and mortgage rates tick upward,” says Todd Teta, chief product officer with ATTOM. “Historically low rates and rising wages are still big reasons why workers can meet or come very close to standard lending benchmarks in a majority of counties we analyze. But the portion of wages required for major ownership expenses nationwide is getting closer to levels where banks become less likely to offer home loans. Amid very uncertain times, with the pandemic again threatening the economy, we will keep watching this key measure of housing market stability.”

Despite the continued decline in historic affordability, major home-ownership expenses on typical homes still are affordable to average local wage earners in about half of the 575 counties in the report, based on the 28% guideline. The largest are Cook County (Chicago), Ill.; Harris County (Houston), Texas; Dallas County, Texas; Bexar County (San Antonio), Texas; and Wayne County (Detroit), Mich.

The most populous of the 279 counties where major expenses on median-priced homes are unaffordable for average local workers in the fourth quarter of 2021 are Los Angeles County, Calif.; Maricopa County (Phoenix), Ariz.; San Diego County, Calif.; Orange County, Calif. (outside Los Angeles); and Miami-Dade County, Fla.

Median single-family home prices in the fourth quarter of 2021 are up by at least 10% over the fourth quarter of 2020 in 368, or 64%, of the 575 counties included in the report. Data was analyzed for counties with a population of at least 100,000 and at least 50 single-family home and condo sales in the fourth quarter of 2021.

Among the 43 counties with a population of at least 1 million, the biggest year-over-year gains in median prices during the fourth quarter of 2021 are in Middlesex County (outside Boston), Mass. (up 42%); Wake County (Raleigh), N.C. (up 27%); Maricopa County (Phoenix), Ariz. (up 26%); Hillsborough County (Tampa), Fla. (up 26%); and Clark County (Las Vegas), Nev. (up 23%).

Counties with a population of at least 1 million where median prices have decreased year-over-year in the fourth quarter of 2021, or gone up by the smallest amounts, are Wayne County (Detroit), Mich. (down 12%); Cook County (Chicago), Ill. (down 3%); Kings County (Brooklyn), N.Y. (up 2%); Dallas County, Texas (up 5%); and Contra Costa County, Calif. (up 6%).

Home-price appreciation is greater than weekly wage growth in the fourth quarter of 2021 in 447 of the 575 counties analyzed in the report (78%), with the largest including Harris County (Houston), Texas; Maricopa County (Phoenix), Ariz.; San Diego County, Calif.; Orange County, Calif. (outside Los Angeles); and Miami-Dade County, Fla.

Average annualized wage growth is outpacing home-price appreciation in the fourth quarter of 2021 in 128 of the counties included in the report (22%), including Los Angeles County, Calif.; Cook County, (Chicago), Ill.; Dallas County, Texas; Kings County (Brooklyn), N.Y.; and King County (Seattle), Wash.

Major ownership costs on median-priced homes in the fourth quarter of 2021 consume less than 28% of average local wages in 296 of the 575 counties analyzed in this report (51%), assuming a 20% down payment. That was about the same as in the third quarter of 2021 for the same group of counties, but down from about two-thirds in the fourth quarter of last year.

Counties where the smallest portion of average local wages is required to afford the typical home are Schuylkill County (outside Allentown), Pa. (6.5% of annualized weekly wages needed to buy a home); Macon County (Decatur), Ill. (9.2%); Bibb County (Macon), Ga. (9.5%); Wayne County (Detroit), Mich. (10.6%); and Peoria County, Ill. (11.3%).

Aside from Wayne County, the counties with a population of at least 1 million where major ownership expenses typically consume less than 28% of average local wages in the fourth quarter of 2021 include Philadelphia County, Pa. (15.4%); Cuyahoga County (Cleveland), Ohio (15.7%); Cook County (Chicago), Ill. (20.6%); and Franklin County (Columbus), Ohio (21.8%).

A total of 279 counties in the report (49%) require more than 28% of annualized local weekly wages to afford a typical home in the fourth quarter of 2021. Counties that require the greatest percentage of wages are Kings County (Brooklyn), N.Y. (76.5% of annualized weekly wages needed to buy a home); Santa Cruz County, Calif. (73.7%); Marin County (outside San Francisco), Calif. (71.4%); Maui County, Hawaii (67.3%); and San Luis Obispo County, Calif. (64.7%).

Aside from Kings County, N.Y., the counties with a population of at least 1 million where home ownership consumes the highest percentage of average annualized local wages in the fourth quarter include Orange County (outside Los Angeles), Calif. (60.1%); Queens County, N.Y. (59.9%); Nassau County (outside New York City), N.Y. (56.5%); and Alameda County (Oakland), Calif. (53.4%).

Just one in five counties require annual wage of more than $75,000 to afford typical home

Annual wages of more than $75,000 are needed to afford major costs on the median-priced home purchased during the fourth quarter of 2021 in just 114, or 20%, of the 575 markets in the report.

The top 30 highest annual wages required to afford typical homes are all on the east or west coasts, led by New York County (Manhattan), N.Y. ($274,679); San Mateo County (outside San Francisco), Calif. ($252,589); San Francisco County, Calif. ($251,054); Santa Clara County (San Jose), Calif. ($229,301); and Marin County (outside San Francisco), Calif. ($223,713).

The lowest annual wages required to afford a median-priced home in the fourth quarter of 2021 are in Schuylkill County (outside Allentown), Pa. ($10,927); Bibb County (Macon), Ga. ($16,483); Cambria County (outside Pittsburgh), Pa. ($17,784); Macon County (Decatur), Ill. ($19,317); and Blair County (Altoona), Pa. ($20,363).

Among the 575 counties analyzed in the report, 440 (77%) are less affordable in the fourth quarter of 2021 than their historic affordability averages. That is about the same as in the third quarter of 2020, when 74% of the same group of counties were historically less affordable, but far higher than the 39% level in the fourth quarter of last year.

Counties with a population of at least 1 million that are less affordable than their historic averages (indexes of less than 100 are considered less affordable compared to historic averages) include Tarrant County (Fort Worth), Texas (index of 75); Maricopa County (Phoenix), Ariz. (76); Mecklenburg County (Charlotte), N.C. (77); Hillsborough County (Tampa), Fla. (78); and Clark County (Las Vegas), Nev. (79).

Counties with the worst affordability indexes in the fourth quarter of 2021 include Rankin County (Jackson), Miss. (index of 50); Canyon County (outside Boise), Idaho (60); Rutherford County (Murfreesboro), Tenn. (62); Gaston County (outside Charlotte), N.C. (63); and Wayne County (outside Akron), Ohio (63).

Among counties with a population of at least 1 million, those where the affordability indexes worsened most from the fourth quarter of 2020 to the fourth quarter of 2021 are Middlesex County (outside Boston), Mass. (index down 29%); Wake County (Raleigh), N.C. (down 21%); Maricopa County (Phoenix), Ariz. (down 21%); Hillsborough County (Tampa), Fla. (down 21%); and Clark County (Las Vegas), Nev. (down 19%).

Among the 575 counties in the report, 135 (23%) are more affordable than their historic affordability averages in the fourth quarter of 2021, down slightly from 26% of the same group in the prior quarter and 61 percent in the fourth quarter of last year.

Counties with a population of at least 1 million that are more affordable than their historic averages (indexes of more than 100 are considered more affordable compared to historic averages) include New York County (Manhattan), N.Y. (index of 129); Montgomery County (outside Washington, D.C.), Md. (119); Cook County (Chicago), Ill. (113); Santa Clara County (San Jose), Calif. (113); and Fairfax County (outside Washington, D.C.), Va. (109).

Counties with the best affordability indexes in the fourth quarter of 2021 include Macon County (Decatur), Ill. (index of 191); Schuylkill County (outside Allentown), Pa. (160); San Francisco County, Calif. (144); Peoria County, Ill. (135); and Columbiana County (west of Pittsburgh, Pa.), Ohio (135).

Counties with a population of least 1 million residents where the affordability index improved most or declined the least from the fourth quarter of last year to the same period this year are Wayne County (Detroit), Mich. (index up 11%); Cook County (Chicago), Ill. (up 3%); Santa Clara County (San Jose), Calif. (down 2%); Kings County (Brooklyn), N.Y. (down 4%); and Montgomery County (outside Washington, DC), Md. (down 4%).