ATTOM has released its 2022 Rental Affordability Report, which shows that owning a median-priced home is more affordable than the average rent on a three-bedroom property in 666, or 58%, of the 1,154 U.S. counties analyzed for the report.

That means major homeownership expenses consume a smaller portion of average local wages than renting.

Homeownership remains more affordable even though median home prices have increased more than average rents and more than averages wages in in 88% of the counties analyzed.

The analysis incorporated recently released fair-market rent data for 2022 from the U.S. Department of Housing and Urban Development, wage data from the Bureau of Labor Statistics and public-record sales-deed data from ATTOM in 1,154 U.S. counties with sufficient single-family home sales data.

The data shows that homeownership is more affordable in a majority of the country, as it was in 2021, following another year when the benefits of rising wages and super-low mortgage rates counteracted the effects of home prices spiking around the U.S. Prices have shot up more than 10% in most of the country over the past year as a glut of home buyers, partly spurred by the ongoing coronavirus pandemic, chase a tight supply of homes for sale. But average wages have increased about 8 percent while interest rates have hovered around 3%, helping to maintain ownership affordability.

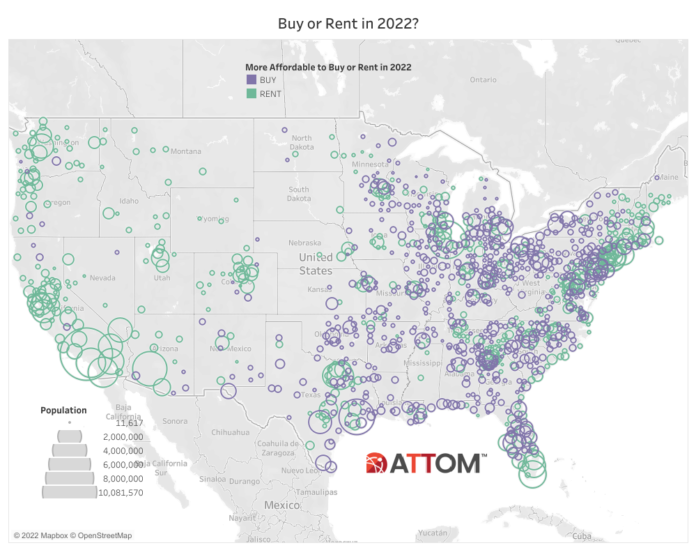

Trends favoring homeownership show up most in less-populous suburban and rural areas with the most affordable home values, while renting remains more affordable in the biggest metropolitan areas.

“Home prices are rising faster than both rents and wages while wages rise faster than rents. And the housing market boom of the past decade keeps pushing home values to new records. Yet homeownership still remains the more affordable option for average workers in a majority of the country because it still takes up a smaller portion of their pay,” says Todd Teta, chief product officer with ATTOM.

“The trend is slowly shifting toward renters, which could be a major force in easing price increases in 2022,” adds Teta. “Prices can only go up by so much more before renting becomes financially easier. For now, though, rising wages and interest rates around 3 percent are enough to offset recent price runups and keep ownership on the plus side of the affordability ledger compared to renting.”

Median prices for three-bedroom homes are increasing more than average three-bedroom rents in 1,015 of the 1,154 counties analyzed in this report (88%). Counties were included if they had at least 500 sales from January through November of 2021.

The most populous counties where home prices are rising faster are Los Angeles County, Calif.; Cook County (Chicago), Ill; Harris County (Houston), Texas; Maricopa County (Phoenix), Ariz.; and San Diego County, Calif.

The largest counties where rents are rising faster than home prices are Allegheny County (Pittsburgh), Pa.; Hidalgo County (McAllen), Texas; Ventura County, Calif. (outside Los Angeles); Jackson County (Kansas City), Mo.; and Lake County, Ind. (outside Chicago).

Renting is more affordable for average wage earners than buying a home in 21 of the nation’s 25 most populated counties and in 35 of 42 counties in the report with a population of 1 million or more (69%). Those counties include Los Angeles County, Calif.; Cook County (Chicago), Ill.; Maricopa County (Phoenix), Ariz.; San Diego County, Calif.; and Orange County, Calif. (outside Los Angeles).

Other counties with a population of more than 1 million where it is more affordable to rent than to buy include locations in the Dallas, Miami, New York City, San Francisco, Washington, D.C., and Riverside (Calif.) metropolitan areas.

Among the 42 U.S. counties analyzed in the report with a population of 1 million or more, those where it is more affordable to buy a home than rent include Harris County (Houston), Texas; Bexar County (San Antonio), Texas; Wayne County (Detroit), Mich.; Philadelphia County, Pa.; and Hillsborough County (Tampa), Fla.

While renting is more affordable in a majority of counties with populations between 500,000 and 1 million, home ownership is the more viable option in counties with a population of less than 500,000. That’s especially true in markets with fewer than 100,000 residents.

Renting is more affordable in 57, or 63%, of the 91 counties in the report with 500,000 to 999,999 people. The largest in this group where renting is more affordable are St. Louis County, Mo.; Honolulu County, Hawaii; Fresno County, Calif.; Collin County, Texas (outside Dallas); and Westchester County, N.Y. (outside New York City).

Among the remaining 1,021 counties, which have a population less than 500,000, owning is more affordable in 625, or 61%. The largest in this group where owning is more affordable are Lake County (Gary), Ind.; Seminole County, Fla. (outside Orlando); Knox County (Knoxville), Tenn.; East Baton Rouge Parish (Baton Rouge), La.; and Jefferson Parish, La. (outside New Orleans).

The largest counties with a population of less than 500,000 where renting is more affordable are Sonoma County (Santa Rosa), Calif.; Morris County, N.J. (outside New York City); Polk County (Des Moines), Iowa; Richmond County (Staten Island), N.Y.; and Clark County, Wash. (outside Portland, OR).

The report shows that renting the typical three-bedroom property requires less than one-third of average local wages in 597 of the 1,154 counties analyzed for the report (52%).

Among the 50 most affordable markets for renting, 43 are in the South and Midwest, led by Steuben County, N.Y. (south of Rochester) (18.8% of average local wages needed to rent); Roane County, Tenn. (west of Knoxville) (18.9%); Gibson County, Ind. (north of Evansville) (19.3%); Benton County (Rogers), Ark. (21.2%); and Sullivan County (Kingsport), Tenn. (21.4%).

The most affordable counties for renting among those with a population of at least 1 million are Allegheny County (Pittsburgh), Pa. (23.7% of average local wages needed to rent); Cuyahoga County (Cleveland), Ohio (23.7%); Fulton County (Atlanta), Ga. (24.7%); Oakland County, Mich. (outside Detroit) (25.8%); and Franklin County (Columbus), Ohio (26.6%).

The 10 least affordable counties for renting are all in the West, led by Santa Cruz County, Calif. (84.2% of average local wages needed to rent); Kauai County, Hawaii (72.1%); Honolulu County, Hawaii (69.5%); Santa Barbara County, Calif. (68.9%); and Monterey County, Calif. (outside San Francisco) (68.3%).

The least affordable for renting among counties with a population of at least 1 million are Kings County (Brooklyn), N.Y. (62% of average local wages needed to rent); Orange County, Calif. (outside Los Angeles) (57%); Queens County, N.Y. (54.5%); Bronx County, N.Y. (53.2%); and Contra Costa County, CA (outside San Francisco) (50.7%).

South and Midwest again have most-affordable home ownership markets while least affordable are in West and Northeast.

The report shows that owning a median-priced three-bedroom home requires less than one-third of average local wages (assuming a 3% down payment) in 630 of the 1,154 counties analyzed for the report (55%).

The most affordable markets for owning are Schuylkill County, Pa. (outside Allentown) (11.1% of average local wages needed to own); Vermillion County, Ill. (east of Champaign) (12.2%); Venango County (Oil City), Pa. (12.6%); Wapello County (Ottumwa), Iowa (12.8%); and Edgecombe County (Rocky Mount), N.C. (12.9%).

The most affordable for owning among counties with a population of at least 1 million are Wayne County (Detroit), Mich. (15.7% of average local wages needed to own); Allegheny County (Pittsburgh), Pa. (20.1%); Cuyahoga County (Cleveland), Ohio (22%); Philadelphia County, Pa. (25.5%); and Harris County (Houston), Texas (28.9%).

The least affordable markets for owning are Summit County (Breckenridge), Colo. (151.3% of average local wages needed to own); Eagle County (Vail), Colo. (139.6%); Marin County, Calif. (outside San Francisco) (121.9%; Santa Cruz County, Calif. (112%); and Summit County, Utah (outside Salt Lake City) (111.2%).

Among counties with a population of at least 1 million, the least affordable for owning are Kings County (Brooklyn), N.Y. (101.6% of average local wages needed to own); Orange County, Calif. (outside Los Angeles) (87.7%); Alameda County (Oakland), Calif. (78.7%); Queens County, N.Y. (77.9%); and Los Angeles County, Calif. (74.7%).

Wages are increasing more than average fair-market rents in 637 of the 1,154 counties analyzed in the report (55%), including Los Angeles County, Calif.; Cook County (Chicago), Ill.; Maricopa County (Phoenix), Ariz.; San Diego County, Calif.; and Orange County, Calif. (outside Los Angeles).

Average fair-market rents are rising faster than average wages in 517 of the 1,154 counties in the report (45%), including Harris County (Houston), Texas; Riverside County, Calif. (outside Los Angeles); Clark County (Las Vegas), Nev.; San Bernardino County, Calif. (outside Los Angeles); and Bexar County (San Antonio), Texas.

Median home prices are rising faster than average weekly wages in 1,013 of the 1,154 counties analyzed in the report (88%), including Los Angeles County, Calif.; Cook County (Chicago), Ill.; Harris County (Houston), Texas; Maricopa County (Phoenix), Ariz.; and San Diego County, Calif.

Average weekly wages are rising faster than median home prices in just 141 of the 1,154 counties in the report (12%), including Santa Clara County (San Jose), Calif.; Allegheny County (Pittsburgh), Pa.; San Francisco County, Calif.; Hidalgo County (McAllen), Texas; and San Mateo County, Calif. (outside San Francisco.