Housing starts slumped in June, as builders struggled to meet rising demand for new homes in a market where existing-home sales have almost completely stagnated, due to higher mortgage rates.

According to estimates from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, housing starts in June were at a seasonally adjusted annual rate of 1.434 million, a decrease of 8% compared with May and down 8.1% compared with June 2022.

Starts of detached single‐family homes were at a rate of 935,000, a decrease of 7% compared with the May.

Starts of multifamily properties (five units or more per building) were at a rate of 482,000, down 11.6% compared with the previous month.

Building permits were also down month-over-month. They were at a seasonally adjusted annual rate of 1.44 million – a decrease of 3.7% compared with May and down 15.3% compared with June 2022.

Permits for single‐family homes were at a rate of 922,000, and increase of 2.2% compared with May.

Permits of multifamily dwellings were at a rate of 467,000, down 13.5% compared with the previous month.

Housing completions were at a seasonally adjusted annual rate of 1.468 million, a decrease of 3.3% compared with the previous month but up 5.5% compared with June 2022.

“There remains pent-up demand in the housing market, but higher mortgage rates put a strain on affordability,” says Odeta Kushi, deputy chief economist for First American, in a statement. “Mortgage rates were 6.67 percent in the week ending June 22nd. By July 13th, mortgage rates had drifted to approximately 7 percent. Holding household income constant, the increase in mortgage rates reduced house-buying power by approximately $10,000.”

Kushi notes that homebuilder sentiment “inched higher in July to the highest level since June 2022.”

“Yet the rise was slower than in months prior, a sign of moderating and cautious optimism,” she says. “Of the index’s three components, current sales conditions and buyer traffic increased, while sales expectations fell.”

“Builders are benefitting from the lack of resale inventory, but higher mortgage rates pose a threat,” Kushi says. “Reduced affordability alongside ongoing supply-side challenges and tighter lending standards for acquisition, development and construction (AD&C) loans could throttle builder momentum.”

“Housing starts posted a monthly decline in June as tightening monetary policy helped push mortgage rates up more than a quarter-point over the past month,” says Alicia Huey, chairman of the National Association of Home Builders (NAHB), in a statement. “Policymakers need to remove regulatory bottlenecks that impede the housing industry’s ability to increase the production of quality, affordable housing.”

“While builders have slowed construction activity as interest rates have approached 7%, we anticipate mortgage rates will stabilize later this year in anticipation of the end of Federal Reserve’s tightening cycle,” adds Danushka Nanayakkara-Skillington, assistant vice president for forecasting and analysis for NAHB. “In turn, this could bring home buyers back to the market as affordability conditions improve. And in another sign of cautious builder optimism, single-family permits registered their highest pace since June 2022.”

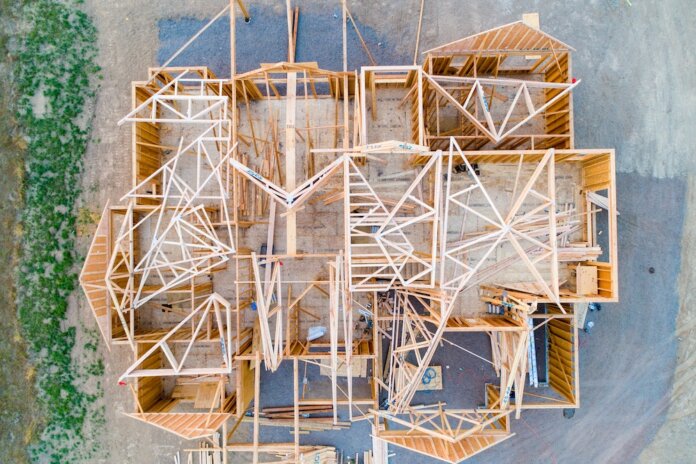

Photo: Avel Chuklanov