Housing starts were at a seasonally adjusted annual rate of 1.277 million in May, a decrease of 5.5% compared with April and down 19.3% compared with May 2023, according to estimates from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

Starts of detached, single‐family homes were at a rate of 982,000, a decrease of 5.2% compared with 1.036 million in April.

Starts of multifamily dwellings (five units r more per building) were at a rate of 278,000, a decrease of 10.3% compared with the previous month.

Building permits also sank, falling 3.8% compared with April to a seasonally adjusted annual rate of 1.386 million. Year-over-year, permits were down 9.5% compared with May 2023.

Permits for single‐family homes were at a rate of 949,000, a decrease of 2.9% compared with April.

Permits for multifamily units were at a rate of 382,000 in May.

Housing completions were at a seasonally adjusted annual rate of 1.514 million, down 8.4% compared with the previous month but up 1.0% compared with a year earlier.

“Overall lower housing production correspond with our latest industry surveys, which show builders are concerned with a high interest environment that is making it harder to get acquisition, development and construction loans to increase home building activity,” says Carl Harris, chairman of the National Association of Home Builders (NAHB), in a statement. “Higher rates for builder and developer loans, along with ongoing supply-side challenges regarding construction labor and buildable lots, are acting as headwinds for new home and apartment construction.”

“It is not just the single-family market that is experiencing challenges,” adds Robert Dietz, chief economist for NAHB. “The three-month moving average for multifamily starts is the lowest since the fall of 2013 as the multifamily development deceleration continues.”

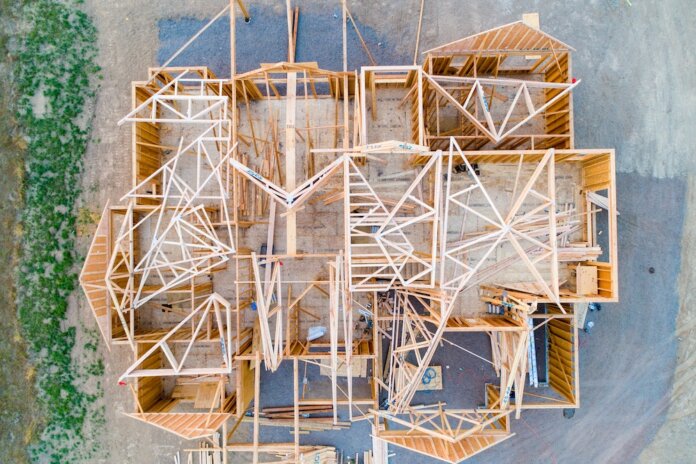

Photo: Avel Chuklanov