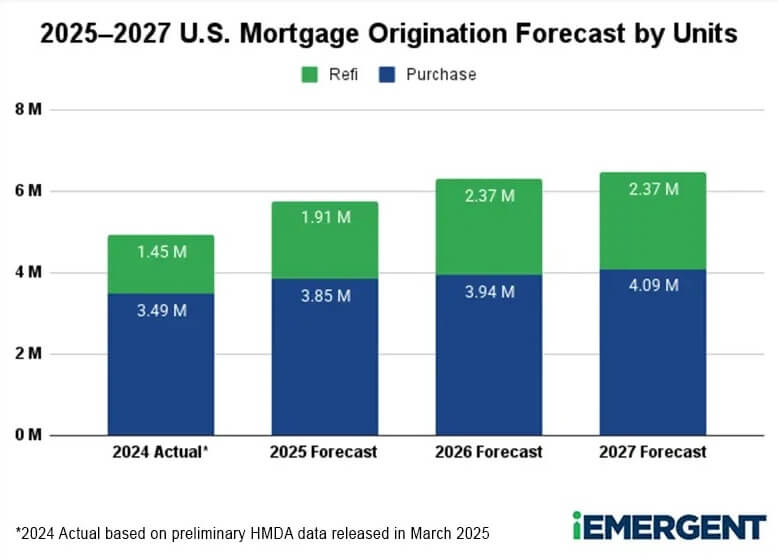

Mortgage originations will climb to $2.27 trillion in 2026, a 13% increase over 2025, as slowing economic growth and easing interest rates fuel a rebound in refinance activity alongside modest purchase gains, according to a report from forecasting and advisory services firm iEmergent.

The firm’s 2025–2027 U.S. Mortgage Origination Forecast predicts that originations in 2025 will surpass $2 trillion for the first time since 2022, driven by a 48% jump in refinance volume and a 12% gain in purchase volume – an overall increase of 20% compared with 2024.

Mark Watson, chief of forecasting for iEmergent, says the outlook reflects a shifting economic landscape. As tariff impacts spread, consumer confidence wanes and the labor market cools, GDP growth is expected to slow further, setting the stage for lower interest rates and a modest housing recovery.

Long-term interest rates are expected to rise slightly by the end of 2025 but fall again in 2026 as growth weakens, the firm predicts. That drop should spur a rebound in refinances and lift overall mortgage originations.

“Crossing back above $2 trillion in 2025 signals renewed strength in the mortgage market,” Watson says. “By 2026, lower rates and moderating home prices should support activity, though affordability challenges will persist — especially for first-time buyers.”

“These national trends tell an important story, but they don’t tell the whole story,” adds Laird Nossuli, CEO of iEmergent. “Every market will experience the next wave of recovery differently. iEmergent’s data gives lenders visibility into those differences, so they can see how mortgage activity is expected to shift in specific markets, even down to the census-tract level.”

Photo: Nicole Avagliano