Florida-based iTHINK Financial Credit Union has selected Black Knight Inc.’s Empower loan origination system (LOS) to automate its origination processes in support of the credit union’s continued business growth.

“iTHINK Financial is growing every year as we attract more and more members, and we needed a loan origination system that will not only support our growth, but will scale as we do,” says Mark Skinner, chief lending officer at iTHINK Financial. “Empower more than fits the bill. It will automate many of the tedious processes our loan officers would otherwise do manually, and now our members will have the tools to complete a mortgage application online that automatically alerts the loan officer and processor in one smooth, seamless process.”

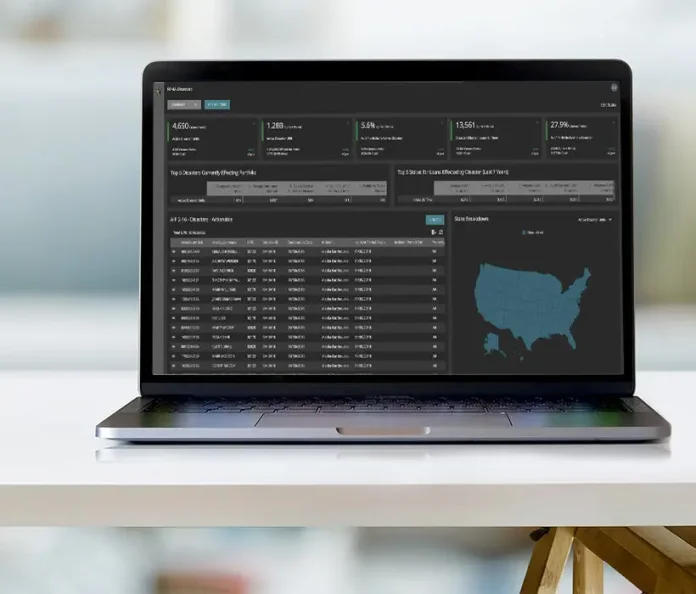

iTHINK Financial has also selected a suite of fully integrated web-based solutions that will allow them to focus on continuing to meet their members’ financial needs. These additional solutions include machine-learning technology for document classification and indexing; a product and pricing engine from Optimal Blue, a division of Black Knight; and a digital point-of-sale solution that enhances the mortgage application process for members and loan officers. In addition, they are utilizing a digital close solution with eDelivery and eSigning capabilities; a solution to assist with regulatory compliance requirements; a comprehensive fee service to help mitigate fee cures; professional flood zone determinations; an advanced business intelligence solution; and a web-based technology that enables lenders to access thousands of service providers directly within the Empower system.

“iTHINK Financial prides itself on offering personalized, ‘white glove’ service and we are confident that Empower will help them keep that commitment,” states Rich Gagliano, president of origination technologies at Black Knight. “With our Empower LOS and its integrated suite of solutions, iTHINK Financial will be able to better support the growth of its business while streamlining processes for increased operational efficiencies and an enhanced member experience.”