Smartfi Home Loans, a reverse mortgage wholesale lender, is now using the LoanPASS product and pricing engine.

With over 110 years of collective reverse mortgage experience, Smartfi Home Loans boasts a seasoned team deeply rooted in the industry. Smartfi operates as a wholesale lender in more than 40 states and continues to expand its commitment to providing secure access to home equity for seniors.

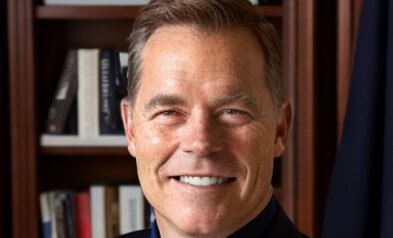

“Smartfi is uniquely positioned in the industry with a team that shares a common vision for how to grow the market and expand home equity use in retirement,” says Gregg Smith, CEO of Smartfi Home Loans, in a release. “Partnering with LoanPASS to implement their Product and Pricing Engine was an easy decision as it seamlessly aligned with our vision. Their innovative solution supports our commitment to streamlining the lending process for our partners.”

“We are thrilled to welcome Smartfi Home Loans as another new customer and valued partner,” says Bill Mitchell, CRO of LoanPASS. “In addition to our shared commitment to drive technology and business process transformation for all our clients, the LoanPASS rules engine was designed to give Smartfi Home Loans complete control over products and pricing.”

“Whether it’s a forward or reverse loan, LoanPASS was designed and architected to break industry convention and disrupt the market for decisioning engine technologies,” Mitchell adds. “LoanPASS is quickly becoming recognized as the leader in advanced pricing engine technology solutions for lending institutions throughout the U.S.”