The Mortgage Bankers Association’s (MBA) Builder Application Survey (BAS) data for October 2021 shows mortgage applications for new home purchases decreased 15.2% compared from a year ago. Compared to September 2021, applications increased by 6%.

“Purchase activity continues to be dominated by higher loan balance transactions, which pushed the average new home loan size up to over $412,000 – another new record in the survey,” explains Joel Kan, MBA’s associate vice president of economic and industry forecasting. “Recent U.S. Census data show an increasing share of new sales are for homes yet to be built or still under construction, and a shrinking share of completed homes. Housing demand remains strong, and buyers are making quick decisions in a still very competitive market.”

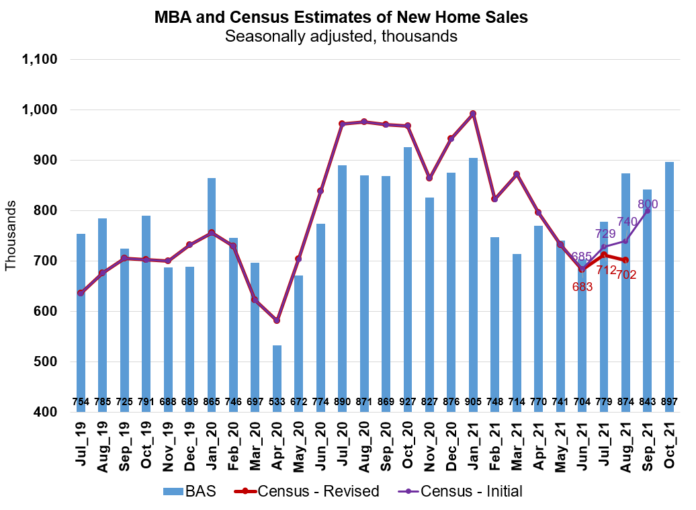

MBA estimates new single-family home sales were running at a seasonally adjusted annual rate of 897,000 units in October 2021, based on data from the BAS. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

“Homebuilders still face delays and challenges from supply-chain bottlenecks and rising costs,” adds Kan. “Overall construction costs, as measured by the Producer Price Index (PPI), recorded an annual increase of 12.3 percent in October, which is almost five times the average annual change.”

The seasonally adjusted estimate for October is an increase of 6.4% from the September pace of 843,000 units. On an unadjusted basis, MBA estimates that there were 68,000 new home sales in October 2021, an increase of 3% from 66,000 new home sales in September.

By product type, conventional loans composed 75.7% of loan applications, FHA loans composed 13.5%, RHS/USDA loans composed 0.5% and VA loans composed 10.3%. The average loan size of new homes increased from $408,522 in September to $412,339 in October.

MBA’s Builder Application Survey tracks application volume from mortgage subsidiaries of home builders across the country. Utilizing this data, as well as data from other sources, MBA is able to provide an early estimate of new home sales volumes at the national, state, and metro level. This data also provides information regarding the types of loans used by new home buyers. Official new home sales estimates are conducted by the Census Bureau on a monthly basis. In that data, new home sales are recorded at contract signing, which is typically coincident with the mortgage application.