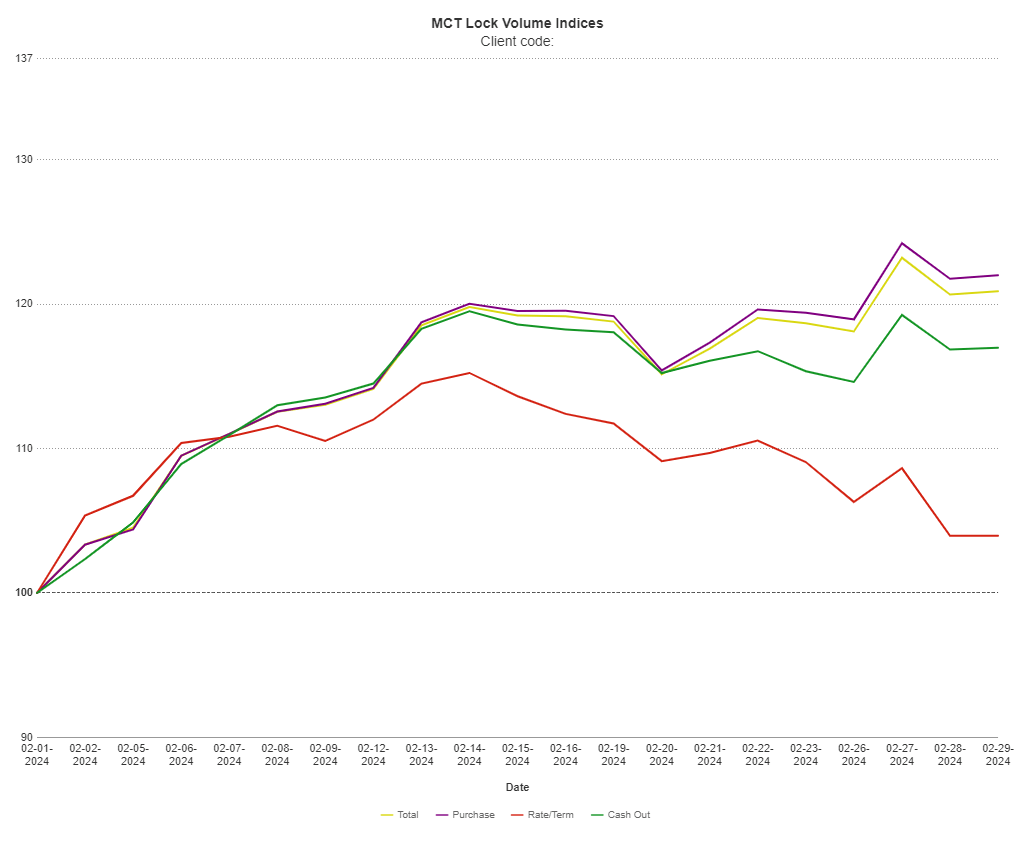

Mortgage lock volume increased 20.9% in February compared with January as buyer sentiment turned more positive, according to advisory firm Mortgage Capital Trading.

However, it’s important to note that this month-over-month uptick represents a relative change, reflective of the traditionally slower winter buying season.

In January, lock volume increased 14% relative to December, the firm reported last month.

The increase in February comes against a backdrop of rising interest rates, a robust jobs market, and a stronger-than-predicted CPI report.

Looking ahead, the Federal Reserve will closely monitor forthcoming non-farm payroll and inflation reports to inform decisions regarding potential rate adjustments.

Andrew Rhodes, senior director and head of trading at MCT, emphasized the significance of these impending reports, stating, “The upcoming non-farm payroll and CPI reports will have a significant impact on the decision for the upcoming Fed meeting in terms of forward guidance. If we continue to see higher than anticipated job and inflation reports, we could see market expectations start to push rate cuts out to the third quarter or later which could act to depress mortgage volume.”

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

Photo: Georg Bommeli