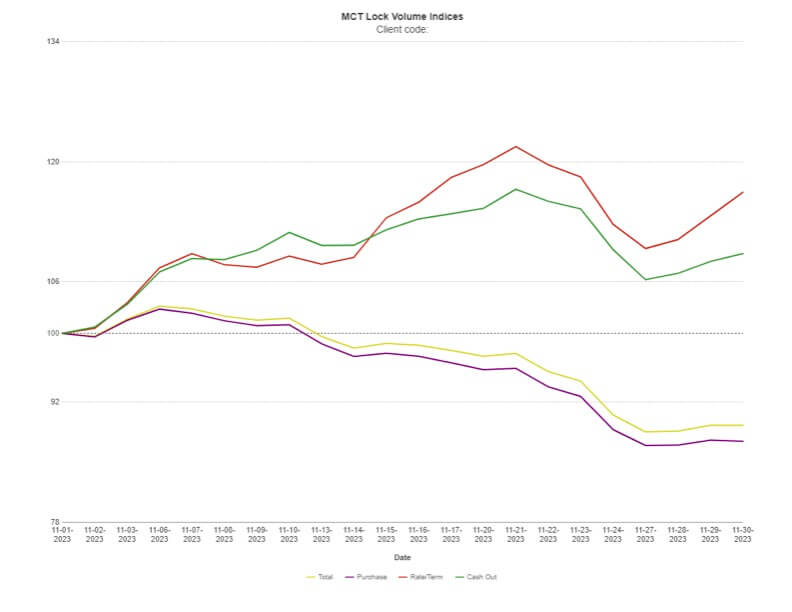

Mortgage rate lock volume fell 10.7% in November compared with October, despite lower mortgage rates, according to Mortgage Capital Trading’s (MCT) monthly Lock Volume Indices report.

The data indicates a nuanced pattern, with a slight uptick in lock volume early in the month attributed to a marginal drop in mortgage rates and increased activity from a mortgage-backed securities (MBS) rally.

However, this surge was short-lived as volume plateaued and subsequently decreased throughout the remainder of the month, with the Thanksgiving holiday potentially contributing to this trend.

Against the backdrop of these market dynamics, the mortgage industry is hoping for reprieve as The Federal Reserve indicated we may have reached the terminal federal funds rate.

“While we’ve seen a decrease in mortgage rates from the highs which would alleviate the seasonal dip, we are still struggling with low supply and see that as a continued trend through the beginning of 2024,” says Andrew Rhodes, senior director and head of trading at MCT, in a statement.

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.