Mortgage credit availability increased in August according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool.

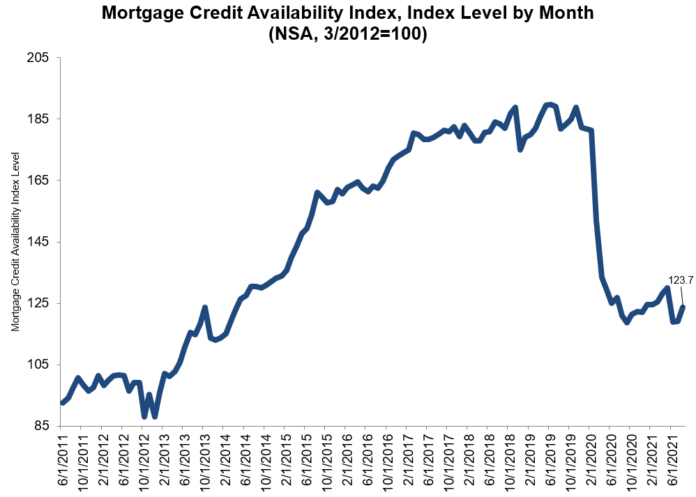

The MCAI rose by 3.9% to 123.7 in August. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

The Conventional MCAI increased 7.6%, while the Government MCAI increased by 1.1%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 9.4%, and the Conforming MCAI rose by 5.1%.

“Credit availability increased in August, driven by significant activity across all indexes,” says Joel Kan, MBA’s associate vice president of economic and industry forecasting. “This expansion was heavily driven by the addition of refinance loan programs at a time when the 30-year fixed rate has been above 3 percent for the past month, and refinance activity has trended lower.”

“Of note, jumbo credit availability increased 9 percent to its highest level since March 2020, as more non-QM jumbo and agency-eligible high-balance loan programs were offered,” Kan continues. “In the conforming space, more lenders offered GSE refinance programs catered to lower-income borrowers to help reduce their rates and payments. There was also a slight expansion in government credit, as more investors offered streamline refinance options for FHA and VA loans.”