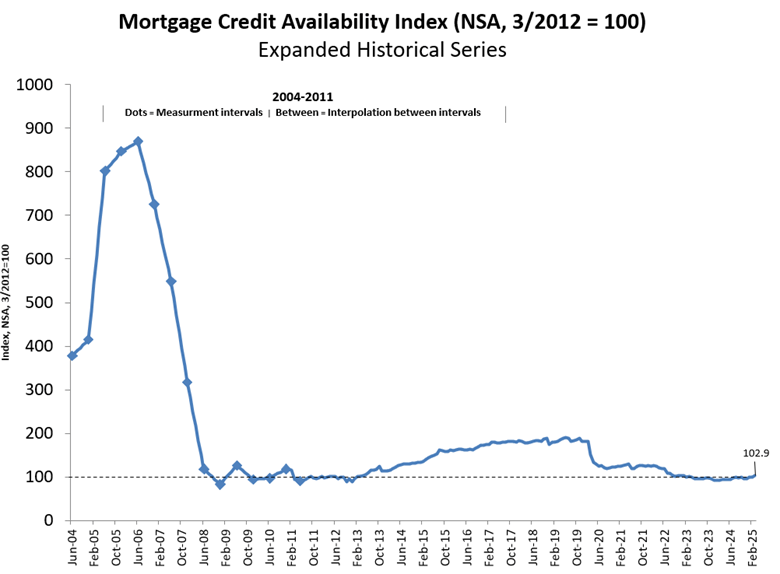

Mortgage credit availability increased in March, rising 2.5% to a score of 102.9 on the Mortgage Bankers Association’s (MBA) Mortgage Credit Availability Index (MCAI).

It was the fourth consecutive month that mortgage credit availability increased, as per the index.

A decrease in the index score indicates that lending standards are tightening, while increases are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

Mortgage credit availability for conventional loans increased 4.7% in March, while the credit for government loans decreased by 0.1%.

Of the component indices of the conventional index, credit for jumbo loans increased by 6.6% while credit for conforming increased by 0.2%.

“Mortgage credit availability increased to its highest level since January 2023, driven by growth in cash-out refinance programs, as recent mortgage rate volatility has opened the door for some borrowers to refinance,” says Joel Kan, vice president and deputy chief economist for the MBA, in a statement. “The credit supply growth was primarily in conventional programs, with jumbo availability at its highest in five years. Government credit availability was essentially unchanged over the month. Additionally, non-QM credit availability continues to grow.”

Photo: Pepi Stojanovski