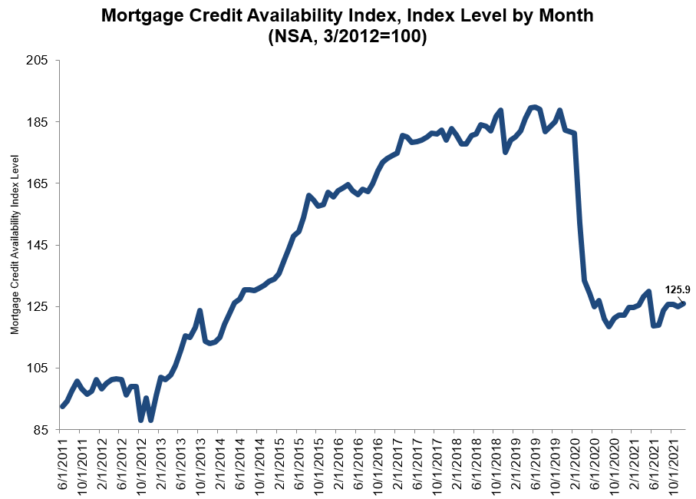

Mortgage credit availability increased in December 2021, according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool.

The MCAI rose by 0.8% to 125.9 in December.

“Credit supply increased in December, with growth across both conventional and government segments of the market. The overall credit index increased to its highest level since May 2021, but remained 30 percent below its pre-pandemic level,” says Joel Kan, MBA’s associate vice president of economic and industry forecasting.”

A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Conventional MCAI increased 0.8%, while the Government MCAI increased by 0.7%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 0.6%, and the Conforming MCAI rose by 1.1%.

“December’s growth was driven by more ARM and lower credit score loan programs, which was likely due to a combination of the rising rate environment and affordability challenges,” Kan continues. “Lenders expanded offerings to qualified borrowers who were the most impacted by these market conditions. Additionally, there was an increase in government streamline refinance programs to aid borrowers still looking to refinance before rates rise even more.”

“The overall supply of mortgage credit only grew around 3 percent compared to the same month a year ago, with a 34 percent increase in jumbo credit availability contributing to most of that growth,” adds Kan. Government credit supply, as well as conforming credit, saw tightening last year.”