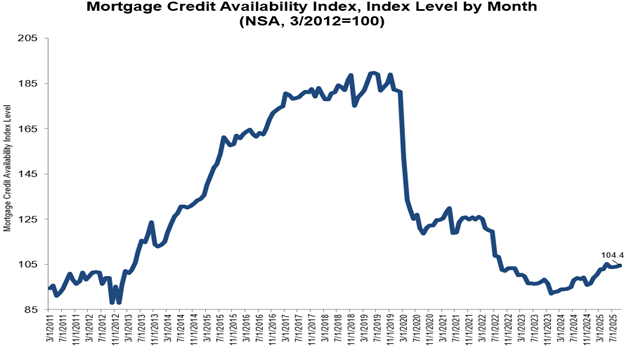

Mortgage credit availability increased 0.4% in September, rising to a score of 104.4 on the Mortgage Bankers Association’s (MBA) Mortgage Credit Availability Index (MCAI).

A decrease in the index score indicates that lending standards are tightening, while increases are indicative of loosening credit.

The index was benchmarked to 100 in March 2012.

Credit availability for conventional loans increased 0.1%, while credit for government loans increased by 0.8%.

Credit availability for jumbo loans decreased by 0.1% while credit for conforming loans increased by 0.7%.

“Mortgage credit availability increased to its highest level in four months, driven by a growing supply of ARM loans, both in terms of more ARM products and broader eligibility requirements,” says Joel Kan, vice president and deputy chief economist, in a statement. “The ARM share of applications has moved higher recently because ARM loan rates remain around 80 basis points lower than fixed-rate loans. Because bank funding costs are more sensitive to Federal Reserve rate cuts than fixed-rate mortgage rates, it is not surprising to see more ARM offerings.”

Photo: Luis Tosta