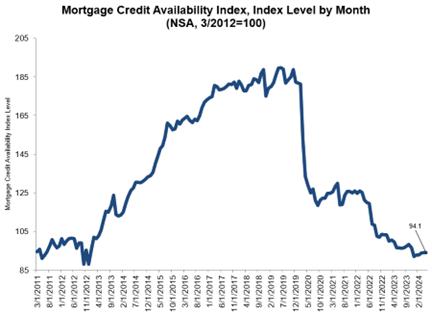

Mortgage credit availability increased 0.1% in May compared with April, rising to a score of 94.1 on the Mortgage Bankers Association’s (MBA) Mortgage Credit Availability Index (MCAI).

Despite the slight increase, mortgage credit remains very tight by historical standards.

A decline in the MCAI indicates that lending standards are tightening, while increases are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

Credit availability for conventional loans increased 0.3% while credit for government loans decreased by 0.1%.

Credit availability for jumbo loans increased by 0.1% and credit for conforming loans increased by 0.5%.

“Mortgage credit availability rose gradually in May and has increased for five consecutive months,” says Joel Kan, vice president and deputy chief economist for the MBA, in a statement. “The overall supply of mortgage credit is still close to 2012 lows, but is slowly increasing.”

“The industry has reduced capacity over the past two years in response to extremely low unit volumes,” Kan adds. “Conventional, conforming, and jumbo credit availability have expanded slightly in recent months as lenders broaden loan offerings to reach more potential homebuyers in a tight purchase market.”

Photo: Maria Ziegler