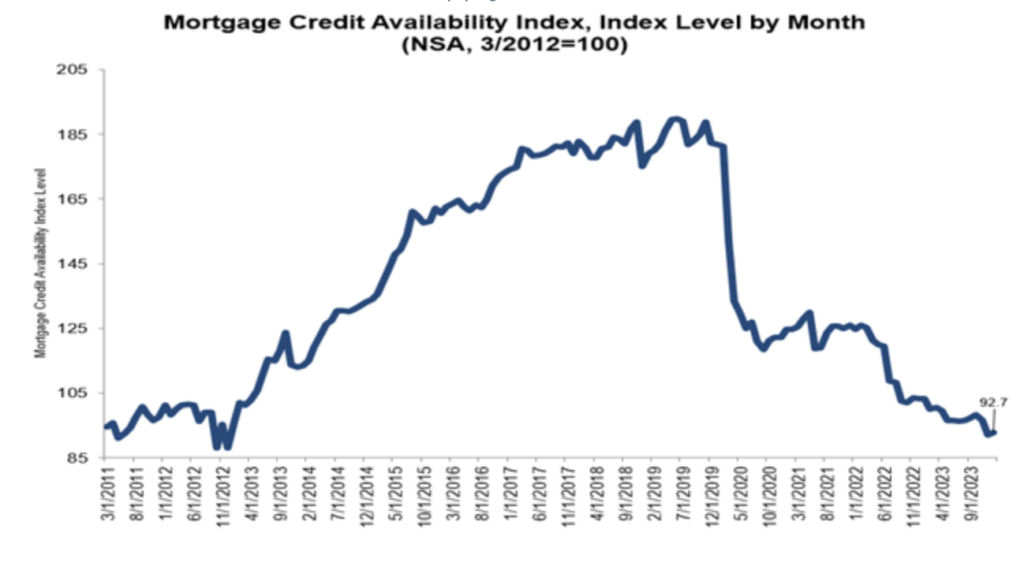

Mortgage credit availability increased in January, rising to a score of 92.7 on the Mortgage Bankers Association’s (MBA) Mortgage Credit Availability Index (MCAI).

That’s an increase of 0.7% compared with December.

A decline in the MCAI indicates that lending standards are tightening, while increases are indicative of loosening credit.

The index was benchmarked to 100 in March 2012.

Credit availability for conventional loans increased 1.3%, while credit availability for government loans decreased by 0.0%.

Credit for jumbo loans increased by 1.9% while credit for conforming loans increased by 0.2%.

“There was a slight increase in credit availability in January, driven by a greater number of conventional loan program offerings,” says Joel Kan, vice president and deputy chief economist for the MBA, in a statement. “However, overall credit availability remained close to 2012 lows, and the conventional index was close to its record low in the series dating back to 2011.”

“Even though there was an increase in cash-out refinance programs available, credit supply overall is tight,” Kan adds. “The challenging lending environment has pushed many lenders to reduce costs by cutting back on certain aspects of their business, including exiting origination channels, which has contributed to lower credit supply.”

Photo: Tierra Mallorca