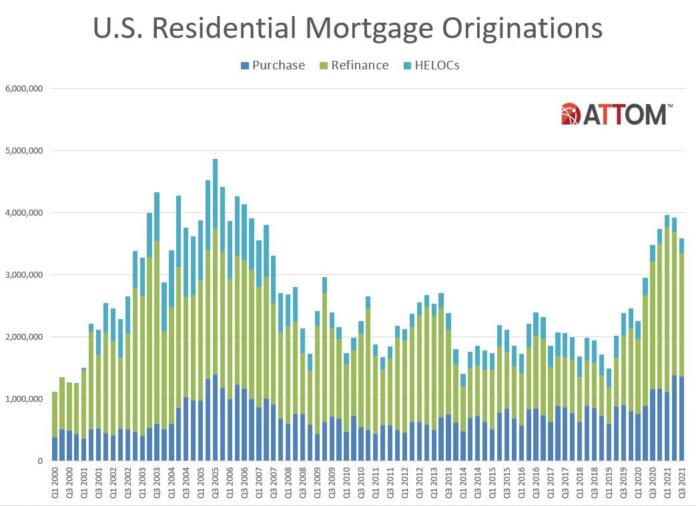

ATTOM‘s third-quarter 2021 U.S. Residential Property Mortgage Origination Report shows that 3.59 million mortgages secured by residential property (1 to 4 units) were originated in the third quarter of 2021. That figure was up 3% from the third quarter of 2020, but down 8% from the second quarter of 2021 – the largest quarterly dip in over a year.

The quarterly decline also was the second in a row and pointed to two unusual patterns developing in the lending industry. It marked the first time in more than two years that total lending decreased in two consecutive quarters. More notably, it was the first time in any year since at least 2000 that lending activity declined in both the second and third quarters, which usually are peak buying seasons.

That pattern emerged amid declines in both refinance and purchase lending which more than made up for a bump up in home-equity lines of credit.

Overall, with average interest rates remaining below 3% for 30-year home loans, lenders issued $1.15 trillion worth of mortgages in the third quarter of 2021. That was up annually by 11%, but down quarterly by 6%. The quarterly decrease in the dollar volume of loans was the first since the early part of 2020.

On the refinance side, 1.99 million home loans were rolled over into new mortgages during the third quarter of 2021, a figure that was down 13% from the second quarter and down 3% from a year earlier. The total number of refinance mortgages has declined for the second straight quarter, while the quarterly decrease was the largest in three years. The dollar volume of refinance loans was down 10% from the second quarter of 2021, to $624.1 billion, although still up annually by 1%.

Refinance mortgages remained a majority of all residential lending activity during the third quarter of 2021. But that portion dipped to 55%, down from 59% in both the second quarter of 2021 and the third quarter of 2020.

The number of purchase loans also declined in the third quarter of 2021 as lenders issued 1.36 million mortgages to buyers. That was down 2% quarterly, although still up annually by 17%. The dollar value of loans taken out to buy property dipped to $482.6 billion, down 1% from the second quarter of this year but still up 30% from the third quarter of 2020.

Home-equity lending, meanwhile, rose for the second straight quarter, which last happened in mid-2019. The tally of home-equity lines of credit, while down annually by 9%, rose 2% between the second and third quarters of 2021, to about 238,500.

The continued dip in total loan activity during the third quarter represented a growing sign that the nation’s appetite for new home loans is easing – and that the nation’s decade-long housing market boom could even be cooling off.

The latest trends have reversed patterns seen from early 2019 through early 2021, when total lending activity nearly tripled amid various forces that pushed a frenzy of refinancing and purchasing. That surge came as interest rates dropped to historic lows and the Coronavirus pandemic which hit early last year spurred a rush of home buying among households looking for larger spaces and the perceived safety offered by a house and yard. That spike in buying has driven home prices to record highs.

“The overflow stack of work that was hitting lenders for several years shrank again in the third quarter across the U.S. amid a few emerging trends,” says Todd Teta, chief product officer at ATTOM. “It looks more and more like homeowner’s voracious appetites for refinance deals has eased notably, while purchase lending also dipped. It’s still too early to say if the trends point to major shifts in lending patterns or the broader housing market boom. But the drop-off is significant, especially for home buying, which could suggest an impending housing market slowdown. We will be watching the lending trends extra closely in the coming months.”

Banks and other lenders issued 3,591,794 residential mortgages in the third quarter of 2021. That was down 8.4% from 3,922,248 in second quarter of 2021, although still up 3.2% from 3,479,655 in the third quarter of 2020. The quarterly decrease was the second in a row, which had not happened since a period running from late 2018 into early 2019. It also stood out as the first time since at least 2000 that total lending activity went down from both the first to the second quarter and from the second to the third quarter of any year.

The $1.15 trillion dollar volume of all loans in the third quarter remained up 10.7% from $1.04 trillion a year earlier, but was down 6% from $1.23 trillion in the second quarter of 2021.

Overall lending activity decreased from the second quarter of 2021 to the third quarter of 2021 in 186, or 86%, of the 216 metropolitan statistical areas around the country with a population greater than 200,000 and at least 1,000 total loans in the third quarter. Total lending activity was down at least 5% in 126 metros (58%). The largest quarterly decreases were in Pittsburgh, Pa. (down 52.3%); Charleston, S.C. (down 48.2%); Myrtle Beach, S.C. (down 46.8%); Provo, Utah (down 39.5%); and Peoria, Ill. (down 33.9%).

Aside from Pittsburgh, metro areas with a population of least 1 million that had the biggest decreases in total loans from the second quarter to the third quarter of 2021 were Buffalo, N.Y. (down 29.8%); Baltimore, Md. (down 20.9%); New Orleans, La. (down 20.4%); and Atlanta, Ga. (down 17.5%).

Metro areas with the biggest increases in the total number of mortgages from the second to the third quarter of 2021 were Ann Arbor, Mich. (up 122.7%); Des Moines, Iowa (up 70.5%); Sioux Falls, S.D. (up 51.5%); Yakima, Wash. (up 31.4%); and Dayton, Ohio (up 30.6%).

The only metro areas with a population of at least 1 million and an increase in total mortgages from the second quarter to the third quarter of 2021 were Jacksonville, Fla. (up 5.5%); Memphis, Tenn. (up 4.3%); and Columbus, Ohio (up 2.7%).

Lenders issued 1,993,407 residential refinance mortgages in the third quarter of 2021, down 13.4% from 2,301,654 in second quarter of 2021 and down 2.9% from 2,053,918 in the third quarter of last year. The total was down for the second straight quarter, which had not happened since late 2018 into early 2019, while the latest decrease was the largest since the first quarter of 2018. The $624.1 billion dollar volume of refinance packages in the third quarter of 2021 was down 10.1% from $694.3 billion in the prior quarter, while it remained up 1.4% from $615.6 billion in the third quarter of 2020.

Refinancing activity decreased from the second quarter of 2021 to the third quarter of 2021 in 199, or 92%, of the 216 metropolitan statistical areas around the country with enough data to analyze. Activity dropped at least 10% in 121 metro areas (56%). The largest quarterly decreases were in Pittsburgh, Pa. (down 61.5%); Myrtle Beach, S.C. (down 54.7%); Charleston, S.C. (down 49.9%); Tuscaloosa, Ala. (down 48.8%); and Buffalo, N.Y. (down 47.5%).

Aside from Pittsburgh and Buffalo, metro areas with a population of least 1 million that had the biggest decreases in refinance activity from the second to the third quarter of 2021 were Rochester, N.Y. (down 28.2%); Baltimore, Md. (down 26.8%); and New York, N.Y. (down 25.8%).

Counter to the national trend, metro areas with the biggest increases in refinancing loans from the second quarter of 2021 to the third quarter of 2021 were Ann Arbor, Mich. (up 128.8%); Des Moines, Iowa (up 91.3%); Sioux Falls, S.D. (up 36.6%); Dayton, Ohio (up 13.4%); and Yakima, Wash. (up 9.9%).

The only metro area with a population of at least 1 million where refinance mortgages increased from the second to the third quarter of 2021 was Jacksonville, FL (up 5.9%).

Refinance mortgages accounted for at least 50% of all loans in 151 (70%) of the 216 metro areas with sufficient data in the third quarter of 2021. But that was down from 83% in the second quarter of 2021 and 80% a year earlier. By the end of the third quarter, refinance mortgages took up a smaller portion of all loans issued in 174 (81%) of the metros analyzed.

Metro areas with a population of at least 1 million where refinance loans represented the largest portion of all mortgages in the third quarter of 2021 were Atlanta, Ga. (72.2% of all mortgages); Detroit, Mich. (66.9%); Kansas City, Mo. (63.2%); New Orleans, La. (62.2%); and New York, N.Y. (62.1%).

Metro areas with a population of at least 1 million where refinance loans represented the smallest portion of all mortgages in the third quarter of 2021 were Rochester, N.Y. (40.9% of all mortgages); Oklahoma City, Okla. (43.2%); Pittsburgh, Pa. (48.1%); Miami, Fla. (48.2%); and Cleveland, Ohio (48.6%).

Lenders originated 1,359,888 purchase mortgages in the third quarter of 2021. That was down 2% from 1,387,307 in the second quarter, although still up 16.8% from 1,163,790 in the third quarter of last year. The $482.6 billion dollar volume of purchase loans in the third quarter was down 0.7% from $486 billion in the prior quarter, but remained up 29.9% from $371.6 billion a year earlier.

Residential purchase-mortgage originations decreased from the second to the third quarter of 2021 in 111 of the 216 metro areas in the report (51%). The largest quarterly decreases were in Jackson, Miss. (down 57.1%); Charleston, S.C. (down 43.8%); Provo, Utah (down 43.6%); Pittsburgh, Pa. (down 42.2%) and Myrtle Beach, S.C. (down 38.4%).

Aside from Pittsburgh, metro areas with a population of at least 1 million and the biggest quarterly decreases in purchase originations in the third quarter of 2021 were New Orleans, La. (down 21.4%); Atlanta, Ga. (down 18%); Austin, Texas (down 16.9%); and San Jose, Calif. (down 15.7%).

Residential purchase-mortgage lending increased from the second quarter of 2021 to the third quarter of 2021 in 105 of the 216 metro areas in the report (49%). The largest increases were in Tuscaloosa, Ala. (up 553.7%); Ann Arbor, Mich. (up 120.6%); Yakima, Wash. (up 66.2%); Dayton, Ohio (up 63.3); and Sioux Falls, S.C. (up 61.7%).

Metro areas with a population of at least 1 million and the largest increases in purchase originations from the second to the third quarter of 2021 were Rochester, N.Y. (up 50.4%); Buffalo, N.Y. (up 37.4%); Philadelphia, Pa. (up 25.2%); Columbus, Ohio (up 24.5%); and Detroit, MI (up 20.1%).