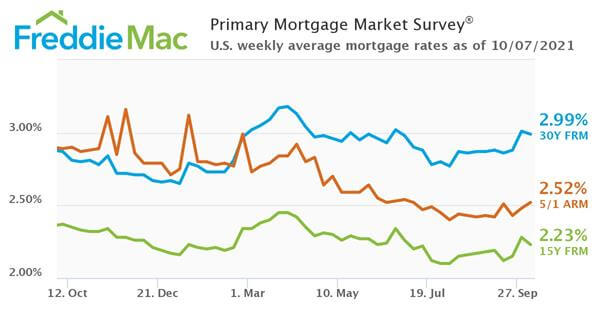

Freddie Mac’s Primary Mortgage Market Survey (PMMS) results show that the 30-year fixed-rate mortgage (FRM) averaged 2.99% for the week ending October 7.

“Mortgage rates continue to hover at around three percent again this week due to rising economic and financial market uncertainties,” says Sam Khater, Freddie Mac’s chief economist. “Unfortunately, with the expectation that both mortgage rates and home prices will continue to rise, competition remains high and housing affordability is declining.”

The 30-year fixed-rate mortgage averaged 2.99% with an average 0.7 point, down slightly from last week when it averaged 3.01%. A year ago at this time, the 30-year FRM averaged 2.87%.

The 15-year fixed-rate mortgage averaged 2.23% with an average 0.7 point, down from last week when it averaged 2.28%. A year ago at this time, the 15-year FRM averaged 2.37%. The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.52% with an average 0.3 point, up from last week when it averaged 2.48%. A year ago at this time, the 5-year ARM averaged 2.89%.

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit. Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage.