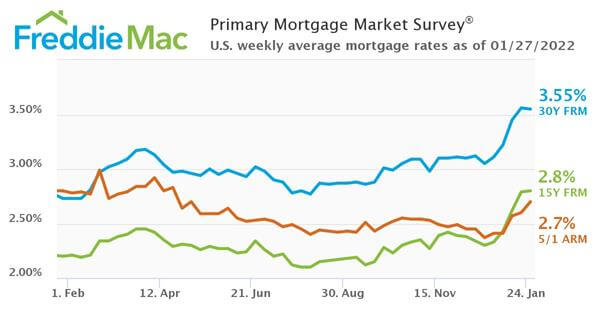

The results of Freddie Mac’s Primary Mortgage Market Survey (PMMS) show that the 30-year fixed-rate mortgage (FRM) averaged 3.55% for the week ending January 27.

“Following a month-long rise, mortgage rates effectively stayed flat this week,” says Sam Khater, Freddie Mac’s chief economist. “Recent rate increases have yet to significantly impact purchase demand, as history demonstrates that potential homebuyers who are on the fence will often enter the market at the start of rate increase cycles.”

“We do expect rates to continue to increase but at a more gradual pace,” adds Khater. “Therefore, a fair number of current homeowners could continue to benefit from refinancing to lower their mortgage payment.”

The 30-year fixed-rate mortgage averaged 3.55% with an average 0.7 point, down slightly from last week when it averaged 3.56%. A year ago at this time, the 30-year FRM averaged 2.73%.

The 15-year fixed-rate mortgage averaged 2.80% with an average 0.6 point, up slightly from last week when it averaged 2.79%. A year ago at this time, the 15-year FRM averaged 2.20%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.70% with an average 0.2 point, up from last week when it averaged 2.60%. A year ago at this time, the 5-year ARM averaged 2.80%.