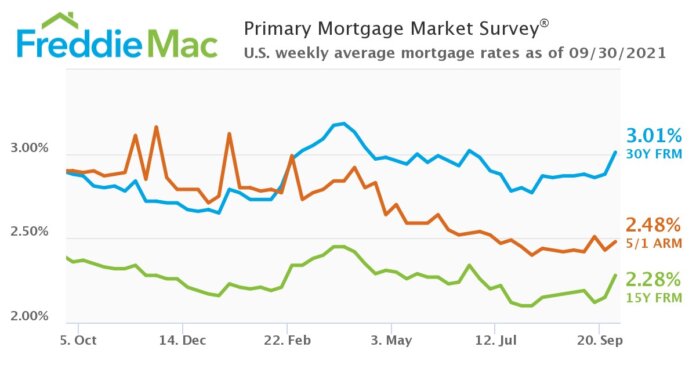

The results of Freddie Mac’s Primary Mortgage Market Survey (PMMS) show that the 30-year fixed-rate mortgage (FRM) averaged 3.01%.

“Mortgage rates rose across all loan types this week as the 10-year U.S. Treasury yield reached its highest point since June,” says Sam Khater, Freddie Mac’s chief economist. “Many factors led to this increase, including the Federal Reserve communicating that it will taper its support of the capital markets, the broadening of inflation and emerging energy supply shortages which compound other labor and materials shortages.”

“We expect mortgage rates to continue to rise modestly which will likely have an impact on home prices, causing them to moderate slightly after increasing over the last year,” continues Khater.

The 30-year fixed-rate mortgage averaged 3.01% with an average 0.7 point for the week ending September 30, 2021, up from last week when it averaged 2.88%. A year ago at this time, the 30-year FRM averaged 2.88%.

The 15-year fixed-rate mortgage averaged 2.28% with an average 0.6 point, up from last week when it averaged 2.15%. A year ago at this time, the 15-year FRM averaged 2.36%. The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.48% with an average 0.3 point, up from last week when it averaged 2.43%. A year ago at this time, the 5-year ARM averaged 2.90%.

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit. Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage.