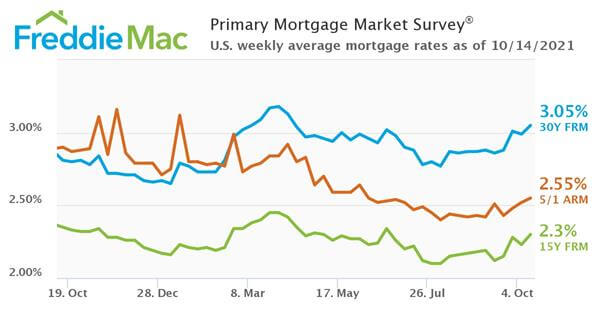

Freddie Mac’s Primary Mortgage Market Survey results show that the 30-year fixed-rate mortgage (FRM) now averages 3.05%.

“The 30-year fixed-rate mortgage rose to its highest point since April,” explains Sam Khater, Freddie Mac’s chief economist. “As inflationary pressure builds due to the ongoing pandemic and tightening monetary policy, we expect rates to continue a modest upswing.”

“Historically speaking, rates are still low, but many potential homebuyers are staying on the sidelines due to high home price growth,” Khater continues. “Rising mortgage rates combined with growing home prices make affordability more challenging for potential homebuyers.”

The 30-year fixed-rate mortgage averaged 3.05% with an average 0.7 point for the week ending October 14 – up from last week, when it averaged 2.99%. A year ago at this time, the 30-year FRM averaged 2.81%.

The 15-year fixed-rate mortgage averaged 2.3% with an average 0.7 point – up from last week, when it averaged 2.23%. A year ago at this time, the 15-year FRM averaged 2.35%. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.55% with an average 0.2 point – up from last week, when it averaged 2.52%. A year ago at this time, the 5-year ARM averaged 2.90%.