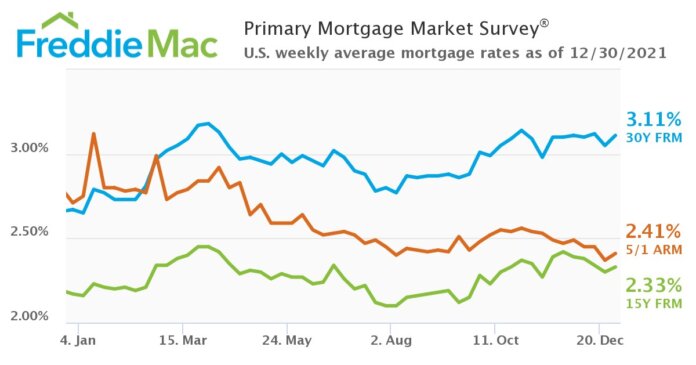

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing that the 30-year fixed-rate mortgage (FRM) averaged 3.11% for the week ending December 30.

“Mortgage rates have effectively been moving sideways despite the increase in new COVID cases. This is because incoming economic data suggests that the economy remains on firm ground, particularly cyclical industries like manufacturing and housing. Moreover, low interest rates and high asset valuations continue to drive consumer spending,” says Sam Khater, Freddie Mac’s chief economist. “While we do expect rates to rise, the push of the first-time homebuyer demographic that’s been propelling the purchase market will continue in 2022 and beyond.”

The 30-year fixed-rate mortgage averaged 3.11% with an average 0.7 point – up from last week, when it averaged 3.05%. A year ago at this time, the 30-year FRM averaged 2.67%.

The 15-year fixed-rate mortgage averaged 2.33% with an average 0.7 point – up from last week, when it averaged 2.30%. A year ago, the 15-year FRM averaged 2.17%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.41% with an average 0.5 point, which was up from last week (2.37%). The five-year ARM averaged 2.71% a year ago.