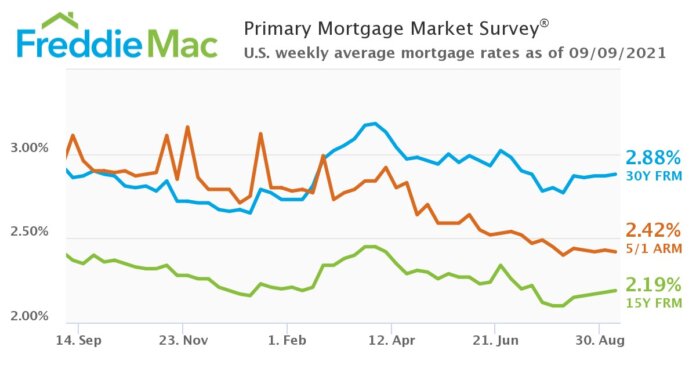

Freddie Mac’s Primary Mortgage Market Survey (PMMS) results for the week ending Sept. 9 show that the 30-year fixed-rate mortgage (FRM) averaged 2.88%.

“While the economy continues to grow, it has lost momentum over the last two months due to the current wave of new COVID cases that has led to weaker employment, lower spending and declining consumer confidence,” says Sam Khater, Freddie Mac’s chief economist. “Consequently, mortgage rates dropped early this summer and have stayed steady despite increases in inflation caused by supply and demand imbalances. The net result for housing is that these low and stable rates allow consumers more time to find the homes they are looking to purchase.”

The 30-year fixed-rate mortgage averaged 2.88% with an average 0.7 point, up slightly from last week, when it averaged 2.87%. A year ago at this time, the 30-year FRM averaged 2.86%.

The 15-year fixed-rate mortgage averaged 2.19% with an average 0.6 point, up slightly from last week, when it averaged 2.18%. A year ago at this time, the 15-year FRM averaged 2.37%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.42% with an average 0.3 point, down slightly from last week, when it averaged 2.43%. A year ago at this time, the 5-year ARM averaged 3.11%.

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit. Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Borrowers may still pay closing costs which are not included in the survey.