Mortgage Bankers Association (MBA) Builder Application Survey (BAS) data for January 2022 show mortgage applications for new home purchases decreased 12.5% compared to a year ago. Compared to December 2021, applications increased by 10%.

“Purchase applications for new homes fell on an annual basis in January, but the 10 percent monthly gain is a positive sign to start the year. While homebuyer demand remains strong, purchase activity is being constrained by higher prices and building delays due to supply chain pressures and building materials shortages,” comments Joel Kan, MBA’s associate vice president of economic and industry forecasting.

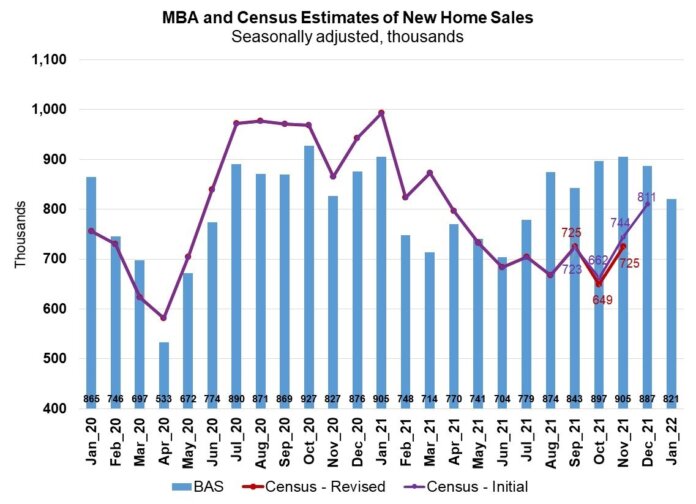

MBA estimates new single-family home sales were running at a seasonally adjusted annual rate of 821,000 units in January 2022, based on data from the BAS. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

“MBA’s estimate of new home sales fell in January to its slowest annual pace since July 2021. Purchase activity for new homes continues to be concentrated in the higher end of the market and overall sales prices continue to increase, as evidenced by another record-setting month for the average loan size at $427,000,” adds Kan.

The seasonally adjusted estimate for January is a decrease of 7.4% from the December pace of 887,000 units. On an unadjusted basis, MBA estimates that there were 66,000 new home sales in January 2022, an increase of 10% from 60,000 new home sales in December.

By product type, conventional loans composed 77% of loan applications, FHA loans composed 13%, RHS/USDA loans composed 0.5% and VA loans composed 9.5%. The average loan size of new homes increased from $423,102 in December to $426,954 in January.