Document and data analysis platform Ocrolus has launched Ocrolus Detect, a comprehensive fraud detection solution for mortgage lenders. Detect provides data that can help lenders minimize risk and prevent losses by automating fraud workflows, providing detailed signals and clear visualizations of fraudulent activity undetectable to the human eye.

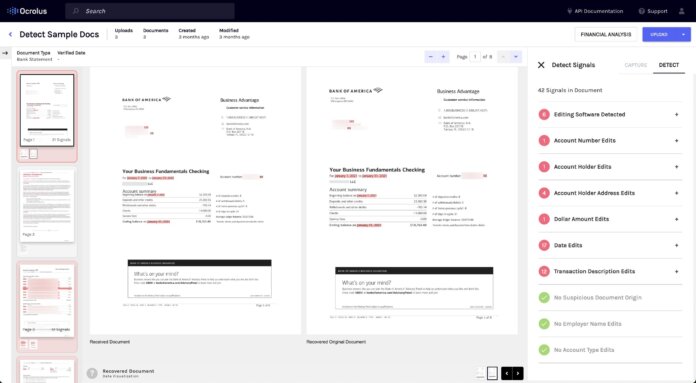

Detect indicates where file tampering has occurred on a document, what fields were modified and how they were changed to provide the necessary level of context for more informed lending decisions. Detect also visualizes file tampering on documents received and often can recover the original document for fraud analysts to easily spot the modified fields.

“Detecting fraud is mission critical to our business, and Ocrolus is uniquely qualified to provide a comprehensive fraud solution with its focus on lending,” says Zack Whitaker, risk operations at AtoB, a fintech company modernizing payments infrastructure for trucking and logistics. “Fraudulent behavior needs to be caught in our underwriting process and Detect has proven to be a highly effective insight tool for our team.”

“As the lending industry shifts to digital loan application processes, fraud is rapidly increasing and becoming more difficult for humans to catch,” comments John Forrester, SVP of product at Ocrolus. “Detect enables lenders to quickly and confidently process more loans by proactively providing them with clear and reliable fraud signals.”