ICE Mortgage Technology, part of Intercontinental Exchange Inc., a global provider of data, technology and market infrastructure, has partnered with PennyMac Loan Services LLC, a subsidiary of PennyMac Financial Services Inc. The integration with ICE Mortgage Technology’s Encompass Investor Connect will make PennyMac one of the largest correspondent aggregator within a network of correspondent investors available on one platform.

The partnership will enable a more streamlined loan delivery, resulting in improved efficiency, loan quality and speed of funding, all at no additional cost to Encompass customers.

“We are excited to expand our partnership with PennyMac as we both work to help further automate the mortgage industry,” says Parvesh Sahi, senior vice president of business and client development at ICE Mortgage Technology. “PennyMac shares our vision to create a seamless digital experience, from concept all the way through loan delivery. By participating in Investor Connect, PennyMac makes it easier for our joint clients to create valuable efficiencies derived from leveraging digital solutions.”

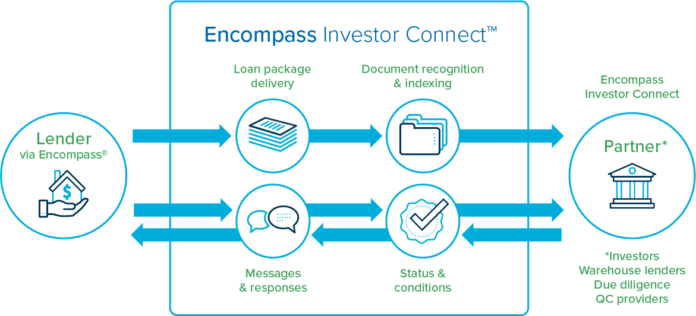

PennyMac is further digitizing loan review and the purchase process by leveraging Encompass Investor Connect’s digital loan delivery. The process also enhances two-way communication to enable sellers to both receive and clear conditions from within their loan pipeline.

“This is another demonstration of PennyMac’s continued commitment to leverage innovative technologies to connect end-to-end processes to improve the loan manufacturing process and customer experience, from borrowers to lenders to correspondent investors,” states Doug Jones, president and chief mortgage banking officer of PennyMac. “As an investor, we reach our customers where their loans reside, which translates to faster receipt of consistent, better-quality loans and allows us, in turn, to review and purchase faster, all leading to more liquidity and opportunity throughout the mortgage process.”