Global supply constraints continue to cap economic output amid growing inflationary and consumer-spending concerns, according to the October 2021 commentary from Fannie Mae’s Economic and Strategic Research (ESR) Group.

For the third consecutive month, the ESR Group revised downward its full-year 2021 real gross domestic product (GDP) growth projections from 5.4% to 4.9% due to its more pessimistic view of the speed at which current supply chain disruptions will resolve, as well as its upwardly revised inflation projections and expectation that services-related consumer spending will take longer to return to a more historically normal level.

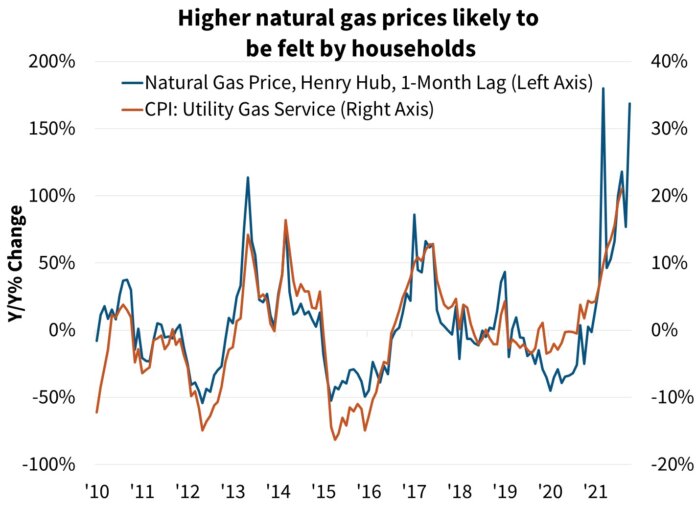

Annual inflation, as measured by the Consumer Price Index, is expected to finish 2021 at 5.7%, up from the previously projected 5.4%, due primarily to elevated energy prices domestically and abroad. To fend off persistently higher inflation, the ESR Group expects the Federal Reserve to announce plans to begin tapering its asset purchase program by the end of the year, and it now projects the first federal funds rate hike to take place in the fourth quarter of 2022.

The ESR Group also highlighted the ongoing impact of supply chain disruptions on housing, including on home price growth and mortgage rate expectations vis-à-vis higher inflation. The ESR Group forecasts mortgage rates to average 3.3% in 2022, up from last month’s projection of 3.1%, as benchmark interest rates are expected to rise due to increased inflation expectations and a projected tightening of monetary policy.

“While we still view the supply chain disruptions and, to a lesser extent, labor market tightness as largely transitory, we now expect both to last even longer than we’d previously forecast – and also likely longer than the Federal Reserve anticipated,” says Doug Duncan, Fannie Mae’s senior vice president and chief economist.

“Combined with our expectation that inflation will run above-target over the forecast horizon, we foresee growing clamor from market participants for the Fed to begin tightening monetary policy: first by tapering asset purchases and then, in the fourth quarter of 2022, by raising the federal funds rate target range for the first time since December 2018,” Duncan adds.

While the ESR Group expects home price growth to decelerate moving into 2022 as the housing market cools from its recent highs, it did revise upward its home price growth forecast by 1.8 points to 16.6% for 2021 and 2.3 points to 7.4% for 2022, as measured by the FHFA Purchase-Only Index, in large part due to persistently tight inventory levels. New single-family home construction remains in high demand but is hindered by many of the same supply constraints, including the availability of both materials and skilled labor, both of which the ESR Group expects will remain obstacles to the delivery of new homes well into next year.

“Even a modest tightening of monetary policy would of course impact housing, but we expect the effects to be largely muted given current market conditions,” Duncan continues. “Mortgage rates may rise in response to the tighter environment, but we expect the severe shortage of homes for sale to remain the primary driver of strong house price appreciation through at least 2022, limiting interest rate effects on home sales and home prices. Right now, we forecast mortgage rates to average 3.3 percent in 2022, which, though slightly higher than 2020 and 2021, by historical standards remains extremely low and supportive of mortgage demand and affordability.”

Find the full October 2021 Economic Outlook here.