Desperate times call for desperate measures.

Faced with high mortgage rates and high home prices, some homebuyers – particularly younger and first-time home buyers – might be overextending in order to get their piece of the American dream, as per a report from Truework.

The report shows that nearly two-thirds of Gen Z and millennial buyers are counting on future rate drops for financial health.

It further reveals that there is a generational divide in home buying confidence and financial stress.

The survey of 1,000 recent U.S. homebuyers reveals a concerning trend: younger buyers are making risky financial bets on their ability to refinance in the future, with nearly two-thirds of Gen Z (64%) and millennial buyers (65%) saying it’s important to their financial health to be able to refinance their mortgage – double the rate of Baby Boomer recent buyers at just 32%.

And, according to the Truework 2025 Recent Homebuyer Report, which surveyed Americans who purchased homes in the past 18-24 months, it’s not just the younger crowd that is banking on a future drop in interest rates.

In fact, more than half (56%) of all recent buyers say that refinancing to a lower rate is important or extremely important to their financial health, and 1 in 4 (25%) say the ability to refinance is “extremely important” to their economic well-being.

“These findings reveal a generation of homebuyers who are taking significant financial risks in today’s market,” says Ethan Winchell, co-founder and president of Truework, a provider of employment and income verification solutions for the mortgage industry. “While homeownership remains a priority, younger buyers are betting their financial future on the hope that interest rates will drop significantly enough to make refinancing viable. “

“Today’s homebuyers are increasingly desperate for a return to lower interest rates, with many who have recently purchased a home hanging their hopes on future refinancing to lower their monthly payments, which could be a very risky move if this doesn’t happen — and most analysts predict it will not anytime soon,” adds Victor Kabdebon, co-founder and CTO for Truework. “And those who are looking to buy today who we spoke with voiced frustration with how high rates have limited the homes they can afford to consider.”

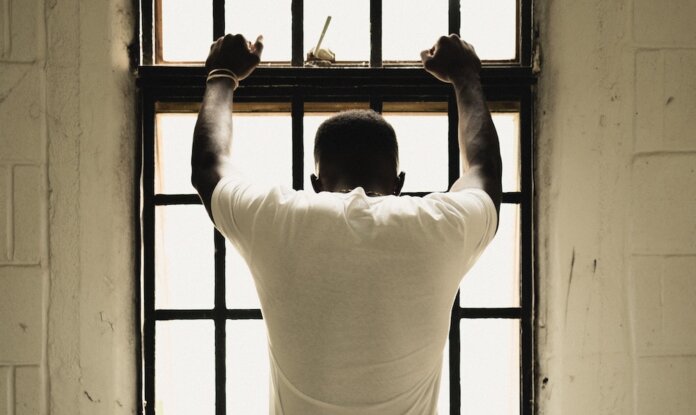

Photo: Karsten Winegeart