Vesta, a mortgage loan origination system software-as-a-service (SaaS) company, has received a $30 million Series A investment led by Andreessen Horowitz, with participation from new investor Zigg Capital. Seed investors Conversion Capital and Bain Capital Ventures also funded the round, bringing the company’s total raised since November 2020 to $35 million.

“Amidst the pandemic in 2020, first-time homeowners and refinancing demand drove home loan origination numbers to all-time record highs and highlighted the need to acquire and serve customers digitally,” says Mike Yu, Vesta founder and CEO. “The significantly increased volume uncovered how inflexible, antiquated and painfully slow the traditional mortgage process can be and challenged the status quo.”

The round will help accelerate efforts to achieve its mission to enable a seamless, transparent experience for financial institutions and their customers through an intelligent, opinionated and intuitive workflow platform. The fresh capital will fuel Vesta’s aggressive hiring plans and expansion of its SaaS technology to customer environments.

“Today, as the market contracts, this shift to digital-first loan origination will accelerate,” Yu adds. “Lenders are motivated more than ever to invest in technologies that open and speed up the process to better serve borrowers, improve margins, and unlock new services. Vesta is modernizing the infrastructure that is the underpinning of the journey to homeownership and beyond.”

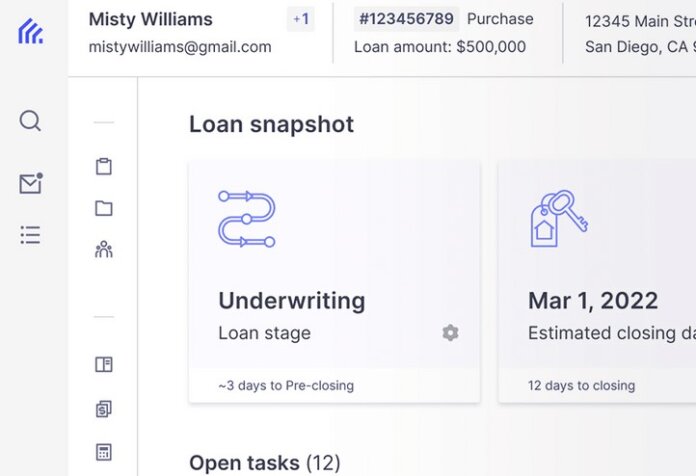

Vesta’s SaaS model expedites the lending process by delivering a consistent, reliable multi-channel platform spanning each step of the origination process, from when a borrower applies for a loan, through application processing, to the disbursement of funds. Vesta’s platform eliminates redundancies, reduces compliance risk, and enables lenders to measure and improve their origination processes. It includes a system of record for loan origination data and documents, a customizable workflow engine, and open APIs and ecosystems.

“While there’s a lot of excitement and investment going into banking and mortgage technology, the industry still lacks a consistent engine to orchestrate and standardize loan origination,” says newly appointed Vesta board member Angela Strange, general partner at Andreessen Horowitz. “It’s about change management as much as anything else because replacing the existing process is hard. It requires the technical and financial know-how to develop and implement a new backbone in a highly-regulated industry.”

“All the players – banks, brokers and title agents – agree that a new system is needed, but to date no one has successfully built it,” continues Strange. “Vesta’s team understands the depth of the problem and is technically adept to solve it. The infrastructure they are creating will be a core driver to automation and adoption in the industry.”