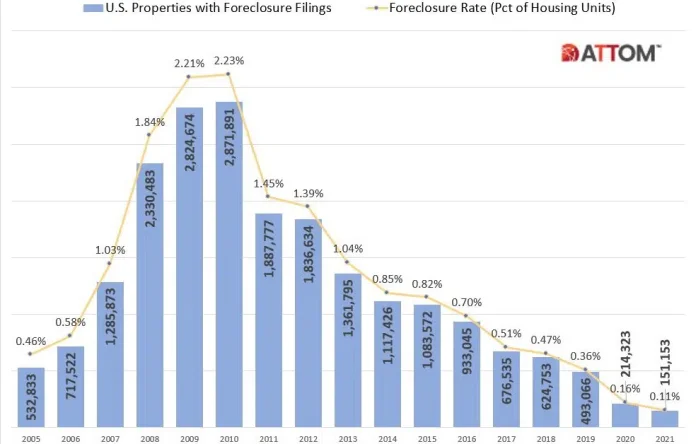

ATTOM has released its Year-End 2021 U.S. Foreclosure Market Report, showing that foreclosure filings – default notices, scheduled auctions and bank repossessions – were reported on 151,153 U.S. properties in 2021, down 29% from 2020 and down 95% from a peak of nearly 2.9 million in 2010, to the lowest level since tracking began in 2005.

Those 151,153 properties with foreclosure filings in 2021 represented 0.11% of all U.S. housing units, down from 0.16% in 2020 and down from a peak of 2.23% in 2010.

“The COVID-19 foreclosure tsunami that some people had anticipated is clearly not happening,” says Rick Sharga, executive vice president at RealtyTrac, an ATTOM company. “Government and mortgage industry efforts have prevented millions of unnecessary foreclosures, and while it’s likely that we’ll see a slight increase in the first quarter, we probably won’t see foreclosure activity back to normal levels before the end of 2022.”

ATTOM’s year-end foreclosure report provides a count of properties with a foreclosure filing during the year based on publicly recorded and published foreclosure filings collected in more than 3,000 counties nationwide, and those counties account for more than 99% of the U.S. population, also available for license or customized reporting.

The report also includes new data for December 2021, showing there were 17,971 U.S. properties with foreclosure filings, down 8% from the previous month but up 65% from a year ago.

Lenders repossessed 25,662 properties through foreclosure (REO) in 2021, down 49% from 2020 and down 98% from a peak of 1,050,500 in 2010, to the lowest level as far back as data is available – 2006.

“We believe that repossessions will continue to be lower than normal throughout 2022,” Sharga notes. “Homeowners have a record amount of equity – over $23 trillion – and over 87 percent of homeowners in foreclosure have positive equity. This means that most borrowers will have an opportunity to sell their house at a profit rather than lose everything to a foreclosure auction.”

States that saw the greatest number of REOs in 2021 included Illinois (3,472 REOs), Florida (2,287 REOs), California (1,839 REOs), Pennsylvania (1,293 REOs) and Texas (1,236 REOs).

Those metropolitan statistical areas with a population greater than 1 million that saw the greatest number of REOs in 2021 included Chicago, Ill. (1,733 REOs); St. Louis, Mo. (1,255 REOs); New York, N.Y. (814 REOs); Baltimore, Md.; and Philadelphia, Pa. (571 REOs).

Lenders started the foreclosure process on 92,346 U.S. properties in 2021, down 30% from 2020 and down 96% from a peak of 2,139,005 in 2009, to a new all-time low going back as far as foreclosure starts data is available – 2006.

States that saw the greatest decline in foreclosure starts from last year included Maryland (down 81%), Oklahoma (down 70%), Idaho (down 64%), Nebraska (down 63%) and Connecticut (down 60%).

“The government’s foreclosure moratorium, the mortgage forbearance program, and the mortgage servicing guidelines enacted by the CFPB in August have kept foreclosure starts artificially low over the past year,” Sharga adds. “While the recovering economy should prevent a huge increase in defaults, we should see a gradual increase in foreclosure activity as these programs expire, and servicers exhaust all loan modification options for delinquent borrowers.”

Counter to the national trend, four states saw an annual increase in foreclosure starts. They included South Dakota (up 20%), Vermont (up 36%), North Dakota (up 71%) and Nevada (up 85%).

Those metropolitan statistical areas with a population greater than 1 million that had at least 500 foreclosure starts in 2021 and saw the greatest declines in foreclosure starts from last year, included Philadelphia, Pa. (down 56%); Washington, DC (down 52%); Charlotte, N.C. (down 51%); Cleveland, Ohio (down 42%); and Chicago, Ill. (down 42%).

However, counter to the national trend, three metropolitan areas with a population greater than 1 million that had at least 500 foreclosure starts in 2021, saw an annual increase. They included Birmingham, Ala. (up 4%); Miami, Fla. (up 17%); and Las Vegas, Nev. (up 142%).

States with the highest foreclosure rates in 2021 were Nevada (0.26% of housing units with a foreclosure filing), Illinois (0.23%), Florida (0.21%), Delaware (0.21%) and New Jersey (0.19%).

Rounding out the top 10 states with the highest foreclosure rates in 2021, were Ohio (0.18%), South Carolina (0.15%), Indiana (0.15%), Connecticut (0.13%) and Maryland (0.13%).

Among 220 metropolitan statistical areas with a population of at least 200,000, those with the highest foreclosure rates in 2021 were Cleveland, Ohio (0.37% of housing units with a foreclosure filing); Las Vegas, Nev. (0.31%); Lake Havasu, Ariz. (0.30%); Peoria, Ill. (0.30%); and Atlantic City, N.J. (0.29%).

Metro areas with a population greater than 1 million, including Cleveland, Ohio and Las Vegas, Nev., that had the highest foreclosure rates in 2021, were, Miami, Fla. (0.25%); Jacksonville, Fla. (0.25%); and St. Louis, Mo. (0.22%).

U.S. properties foreclosed in the fourth quarter of 2021 had been in the foreclosure process an average of 941 days, a 2% increase from the previous quarter and 10% increase from a year ago.

States with the longest average time to foreclose in Q4 2021 were Hawaii (2,491 days), New York (1,529 days), Pennsylvania (1,502 days), Louisiana (1,476 days) and Florida (1,378 days).

There were a total of 56,174 U.S. properties with foreclosure filings in Q4 2021, up 23% from the previous quarter and up 82% from a year ago.

States with the highest foreclosure rates in Q4 2021 were Illinois (one in every 922 housing units with a foreclosure filing), Florida (one in every 1,170 housing units), New Jersey (one in every 1,288 housing units), Nevada (one in every 1,308 housing units) and Ohio (one in every 1,439 housing units).

States with the highest foreclosure rates in December 2021 were Nevada (one in every 3,073 housing units with a foreclosure filing), Florida (one in every 3,813 housing units), Illinois (one in every 3,818 housing units), Delaware (one in every 3,834 housing units) and New Jersey (one in every 3,901 housing units).

Lenders completed the foreclosure process on 3,093 U.S. properties in December 2021, up 33% from the previous month and up 54% from a year ago.