Fannie Mae reveals that the Home Purchase Sentiment Index (HPSI) was largely unchanged in August, decreasing 0.1 points to 75.7, as survey respondents tempered both their recent pessimism about home buying conditions and their upward expectations of home price growth. Overall, three of the index’s six components increased month over month, while the other three decreased.

Most notably, a greater share of consumers believes it’s a good time to buy a home – though that population remains firmly in the minority at only 32% – while the ongoing plurality of respondents who expect home prices to go up over the next 12 months declined to 40%, down from last month’s 46% but still well above the 24% of consumers who believe home prices will decline. Year over year, the full index is down 1.8 points.

“The HPSI remained relatively flat this month, suggesting to us that the continued strength of demand for housing and favorable home selling conditions may be offsetting broader concerns about the Delta variant and inflation that have negatively impacted other consumer confidence indices,” says Mark Palim, Fannie Mae’s vice president and deputy chief economist.

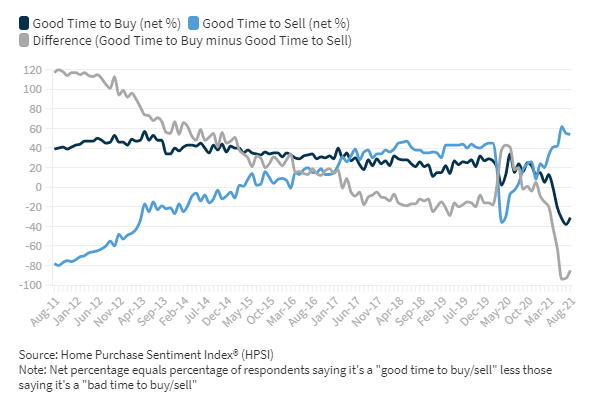

“Most consumers continue to report that it’s a good time to sell a home – but a bad time to buy – and they most frequently cite high home prices and a lack of supply as their primary rationale,” Palim continues. “However, the ‘good time to buy’ component, while still near a survey low, did tick up for the first time since March, perhaps owing in part to the favorable mortgage rate environment and growing expectations that home price growth will begin to moderate over the next twelve months.”

The percentage of respondents who say it is a good time to buy a home increased from 28% to 32%, while the percentage who say it is a bad time to buy decreased from 66% to 63%.

The percentage of respondents who say it is a good time to sell a home decreased from 75% to 73%, while the percentage who say it’s a bad time to sell decreased from 20% to 19%.

The percentage of respondents who say home prices will go up in the next 12 months decreased from 46% to 40%, while the percentage who say home prices will go down increased from 21% to 24%. The share who think home prices will stay the same increased from 27% to 31%.

The percentage of respondents who say mortgage rates will go down in the next 12 months increased from 5% to 6%, while the percentage who expect mortgage rates to go up decreased from 57% to 53%. The share who think mortgage rates will stay the same increased from 31% to 35%. As a result, the net share of Americans who say mortgage rates will go down over the next 12 months increased five percentage point month over month.

Read the full report here.